The tagline from Wall Street was that 2023 was the year of the bond. Instead, fund managers are coming to terms with one of the toughest years ever.

Lacy Hunt, Hoisington Investment Management Co.’s 81-year-old chief economist, who’s been analyzing markets, Federal Reserve policy and the economy for around a half-century, says it’s been the hardest of his entire career.

At HSBC Holdings Plc, Steve Major says he was “wrong” to assume the US government’s growing supply of bonds didn’t matter. Earlier this month, Morgan Stanley finally joined Bank of America and moved to a neutral position on Treasuries.

“It’s been a very, very humbling year,” Hunt said. A 13% year-to-date loss for the firm’s Wasatch-Hoisington U.S. Treasury Fund comes on top of 2022’s 34% drop, data compiled by Bloomberg show.

Last year’s steep losses were easier to explain to clients — everyone knows bond prices suffer when inflation is high and central banks are driving up interest rates.

The expectation in 2023 was that the US economy would crater under the weight of the sharpest run of hikes in decades — bringing gains for bonds on the expectation of policy loosening to come.

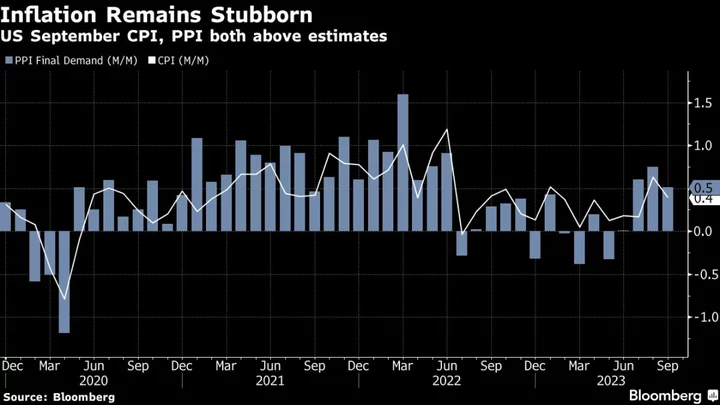

Instead, even as inflation slowed, jobs data and other key measures of the economy’s health remained strong, keeping the threat of faster price growth ever-present. Yields catapulted to highs not seen since 2007, putting the Treasury market on course for an unprecedented third year of annual losses.

And without the Federal Reserve in the market buying bonds to hold down borrowing costs, the US’s massive deficits — and the ballooning issuance needed to plug them — now matter in a way they didn’t before.

Hoisington’s Hunt and his colleagues constantly discussed whether to conduct a wholesale alteration of their favorable view on long-term debt, as their assumption that slowing inflation would curb yields failed to materialize. They did trim their duration earlier in the year, but not sufficiently.

“We thought that inflation would come down and it did,” Hunt said. “In fact, there has been no decline that large in inflation that has not been involved with a recession in its immediate aftermath in the past. So the fact that gross domestic product is still rising is unprecedented.”

At the same time, it’s the expectation that a contraction will eventually happen that’s keeping Wall Street’s bruised bulls from retreating too far as they try to manage their so-called constrained funds that can invest solely in the Treasury market.

“A hard landing is coming,” Hunt said.

Attractive Levels

Bob Michele, chief investment officer for fixed income at J.P. Morgan Asset Management, trimmed the overweight position he’d built in Treasuries when 10-year yields hit 4.30%. They’ve risen by more than 50 basis points since. While the current levels look attractive, the 40-year bond-market veteran is waiting for the dust to settle.

“We have to respect the market technicals and see where this can wash out,” said Michele, who earlier this year predicted yields could come down as low as 3% across the curve by August. If yields on longer maturities go above 5.25% and the employment market stays firm, then it’s time to retreat for real, he said.

For a year touted by the likes of Vanguard Group Inc. and private equity giant KKR & Co Inc as the point where Treasuries roar back — an “anchor in the storm,” Michele said at the time — the reality has been sobering. Since April, the 10-year Treasury yield has posted back-to-back monthly gains.

And while the bond market has clawed back some losses in the past week, it’s fueled by traders hunting the least-risky assets as the war between Israel and Hamas stokes fears of escalation. Behind the gains the core uncertainty hasn’t gone away, with the Fed signaling that the next change in interest rates could be a hike.

Read More: US Consumer Prices Rise at Brisk Pace for Second Straight Month

To be sure, a U-turn now would be costly: many long positions were opened when yields were at 3.75%, according to data compiled by Jefferies International.

And even after the bond slump, there are still metrics that suggest investors can sit tight for longer. The so-called yield-to-duration ratio — a gauge of how much bond yields would need to climb to wipe out the value of future interest payments — is hovering around 89 basis points.

Read More: Bond Traders Are Starting to Bail on Winning Yield-Curve Bets

Despite moving to shorter maturities, Mike Riddell, a portfolio manager at Allianz Global Investors UK Ltd., says he is still “very bullish bonds.” For Aliki Rouffiac who manages multi-asset portfolios for Robeco, higher yields increase the risk of an economic hard landing, which is why she’s using bonds to hedge against a possible prolonged pullback in stocks.

“It’s been a tricky three years,” said Chris Iggo, chief investment officer of core investments at AXA Investment Managers. “The market has given the doubters more reasons to question the value of fixed income. Let me be bold though. Next year will be the year of the bond.”

--With assistance from Garfield Reynolds and Sagarika Jaisinghani.