The blistering rally of Nvidia Corp. following the chipmaker’s blowout revenue forecast is giving one exchange-traded product a massive boost.

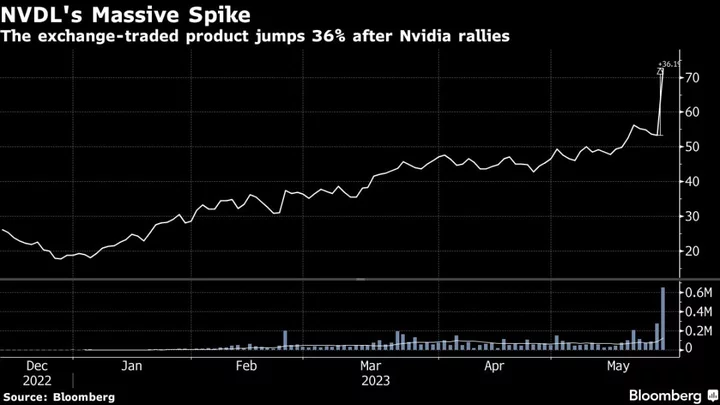

The $41 million GraniteShares 1.5x Long NVDL Daily ETF (ticker NVDL), which tracks 1.5 times the daily performance of Nvidia, has jumped 36% in one-day and 178% since it’s inception in December last year. It’s also seeing 10 times its average volume Thursday to the tune of $41 million.

Hype around artificial intelligence — loosely defined as problem solving using computers and big datasets — has soared since the launch of OpenAI Inc.’s ChatGPT last year, sparking a race among companies to capitalize on the phenomenon. Nvidia’s bullish sales forecast related to AI propelled the company’s market capitalization to the cusp of $1 trillion Thursday, and led gains in the technology sector.

“It takes one event to put these kinds of funds on the map, and this is it for NVDL,” said Bloomberg Intelligence’s Athanasios Psarofagis. “Massive gains like this is a good sign for single-stock ETFs in general.”

ETPs that track single stocks have garnered almost $1 billion in assets, a milestone that underscores the demand for such investment vehicles even as they face criticism for being potentially risky. Issuers have piled into the new market since last year to tap demand from retail traders who bet heavily on their favorite speculative targets. While the segment amounts to just a sliver of the $7 trillion universe of ETPs, industry observers say that the growth in single-stock offerings since their July debut signals a solid appetite.