Months after Apple unveiled a privacy change that threatened Facebook's core advertising business, the social networking company rebranded as Meta and shifted its focus to virtual reality.

Now, less than two years later, Apple may be threatening Meta's business there, too.

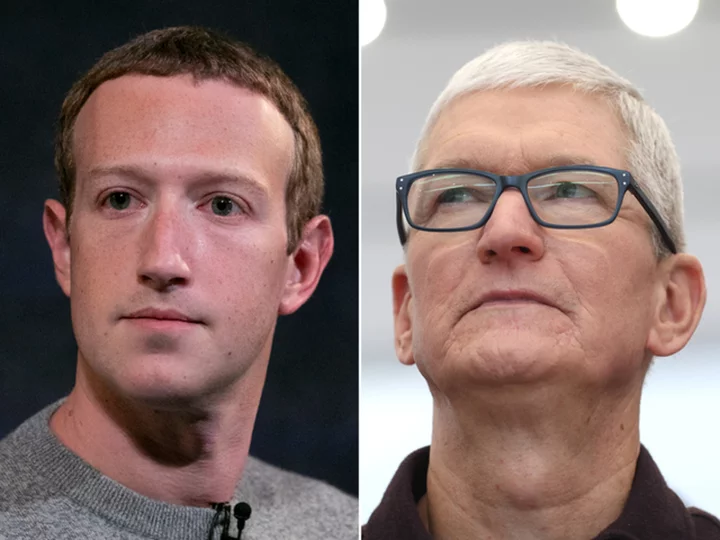

Apple on Monday unveiled its mixed reality headset, the Vision Pro, in one of its most ambitious product launches in years. At the kickoff of the company's annual developer conference, Apple CEO Tim Cook touted the Vision Pro, a $3,499 device that combines virtual reality and augmented reality, as a "revolutionary product," with the potential to change how users interact with technology.

The new Apple product, set to launch early next year, puts Apple in direct competition with Meta, which has been building headsets for years.

On Thursday, just days before WWDC, Meta CEO Mark Zuckerberg tried to preempt the expected Apple headset announcement by teasing the Meta Quest 3. The new headset promises improved performance, new mixed-reality features and a sleeker, more comfortable design, at a much more affordable price ($499).

Every period of consumer tech seems to be shaped by heated rivalries. Apple's competition with Microsoft was central to the early personal computing era. Apple's late CEO Steve Jobs declared "thermonuclear war" against Google over smartphones. Now, Apple and Meta could be the defining rivalry of the VR/AR era.

The two companies had a tense relationship even before Apple's entry into the market. They have competed over news and messaging features, and their CEOs have traded jabs over data privacy and app store policies. Last February, Meta said it expected to take a $10 billion hit in 2022 from Apple's move to limit how apps like Facebook collect data for targeted ads.

But the rivalry appears poised to reach a new level.

Meta has until now been the dominant player in the headset market. But virtual and augmented reality remains a nascent market with little mainstream consumer adoption. The Wall Street Journal reported last year that Meta had just 200,000 active users in Horizon Worlds, its app for socializing in VR. And in 2023, IDC estimates just 10.1 million AR/VR headsets will ship globally from the entire market, far below the tens of millions of iPhones Apple sells each quarter.

Morgan Stanley analysts called Apple's Vision Pro a "moonshot" effort following its announcement on Monday, saying the product "has the potential to become Apple's next compute platform," but that the company has "much to prove" before the headset's launch next year.

"We're always happy when more people join us in building the future," Sheeva Slovan, a spokesperson for Meta's Reality Labs unit, said in a statement to CNN.

A battle to dominate an uncertain market

Apple and Meta may end up racing to see not only who can get consumers to choose their product, but whether either of them can get millions of customers to buy into this new wave of technology at all.

Apple in many ways seems to have the upper hand, with its existing loyal customer base of more than two billion devices, impressive hardware chops and access to hundreds of stores where consumers can potentially try on the device.

"Everything up until this moment has kind of felt like the pregame for me, of preparing for this moment when Apple would take this to the public consciousness and let people know, hey, these technologies are for real, this isn't just a gimmick," Eric Alexander, founder of VR music experiences app Soundscape, told CNN following Apple's announcement.

The iPhone maker also appears to be marketing its device differently. Apple chose not to focus on the term "virtual reality," nor did it show off disembodied avatars without legs inhabiting a virtual world, as Meta did initially. Instead, Apple played up the headset's potential to integrate much more seamlessly with users' real-world lives through augmented reality, a technology that can overlay virtual objects on live video of the real world.

"I don't think Apple views itself in competition with Meta," said Julie Ask, principal analyst at Forrester. Zuckerberg is "all in on this virtual world, and that's not what Apple is about. Apple is saying, 'We don't think people want to be disconnected from the real world ... we want to enhance the world that consumers are in.'"

The Quest 3 headset that Meta teased last week is also a mixed reality headset with AR capabilities, so it seems likely that Meta may veer closer to Apple's approach in the future. However, a demo video Zuckerberg posted to Instagram seems to imply the device is still largely gaming focused.

Many analysts say that the biggest hurdle to consumer adoption of mixed reality headsets is ensuring that there is are a wide range of potential use cases and experiences available on the devices.

While Meta has introduced features that let users play games, explore virtual worlds, watch YouTube videos, workout, chat with friends and more, it has yet to convince most consumers that the device is worthwhile.

Apple's announcement at WWDC seems targeted at ensuring that the large base of developers in its ecosystem will help create enticing new experiences for the device before its launch.

Developing new AR and VR apps requires significant investment, not to mention hands-on time with a device, Alexander said, so it may be a while before a wide range of experiences are available for the Vision Pro. The lack of controllers and other accessories could also make it difficult for developers to create certain types of apps, such as games, for the new device.

Still, at the Monday event, Apple touted features from Disney, such as Disney+, and gaming company Unity, that will be available on the device from the start, on top of the iPhone maker's existing suite of services.

Apple's Vision One "isn't a device that I will buy and think, 'Oh, now I need to go buy content,'" said Forrester's Ask. "This is a device that if I do buy it, it has a very intuitive interface ... it's a place I can watch my Apple TV and movies and all of those things. It's not, 'Oh, I bought this device now what do I do with it?'"

D.A. Davidson analyst Tom Forte compared the Vision Pro's launch to the introduction of the iPhone following the Blackberry, an unfavorable comparison that would likely make Zuckerberg grimace. (Forte did note that Meta's headset seems less likely to fade into irrelevance, as the Blackberry eventually did.)

"Blackberry had proven that there was a market for smartphones and had built a dominant position, but what it didn't really do was the apps," Forte said, adding that the iPhone introduced the idea of having a range of different use cases for one device. "In some regards, it's like the iPhone where we're going to need to see the ecosystem develop over time for this to succeed."

But if Apple does succeed at driving widespread consumer adoption of mixed reality headsets, Meta could still benefit by extension by being the budget pick, Forte said.

Meta's stock rose slightly Tuesday following Apple's announcement.