Operating with a meager budget from a suburban home outside Washington, Will Hild is gearing up for his next battle against Wall Street and the forces behind ESG investing.Hild and his tiny staff at Consumers’ Research are at the forefront of the movement, crafting adversarial campaigns that attack money managers who try to combine profits with altruistic goals by using environmental, social and governance metrics to help decide where to invest. The 37-year-old Hild, backed by powerful right-wing operative Leonard Leo, is part of a network of conservatives committed to defeating ESG, many of them opposed to efforts to mitigate climate change.

He works behind the scenes crisscrossing the nation to lobby Republican state officials to take up the cause, but Hild is equally comfortable being out front—sending bombastic text messages about the evils of “woke” corporations or making media appearances touting ESG as a threat to America.

Most notably, Hild has zeroed in on BlackRock Inc. and its Chief Executive Officer Larry Fink. Operating with an annual budget last year equivalent to 0.002% of BlackRock’s income, he helped catapult ESG from a niche investment strategy mostly popular in Europe to a topic that’s at home on right-wing AM radio talk shows. His efforts contributed to efforts by politicians in Florida, Texas and elsewhere to try to ban the company from doing business with their states.Now, he’s got another target in his sights: Bank of America Corp.

Hild says he’s singling out the second-largest US bank and CEO Brian Moynihan for being the most vocal among Wall Street lenders when it comes to climate risks and other topics tied to ESG, including gun rights and abortion. He cites the bank’s work calculating greenhouse gas emissions for its clients and its internal diversity, equity and inclusion training as particularly egregious behavior.

“This isn't going to be a one-off hit,” Hild said in a video interview. Consumers’ Research plans to run ads on cable news networks pressing the issue, and drive mobile billboards around Bank of America’s headquarters in Charlotte, North Carolina, its offices in midtown Manhattan and some of its busiest branches in states from Arizona to Florida.

Bank of America said in a statement that its focus on “responsible growth is how we deliver industry-leading service to our 68 million American consumers, being a great place to work for our employees and supporting communities across the United States while delivering strong returns for our shareholders.”

The ESG backlash picked up momentum last year. GOP officials have started investigations, created boycott lists and introduced anti-ESG bills. Last month, about two dozen Republican state attorneys general wrote a letter to the Net-Zero Insurance Alliance, a group of insurers committed to working on climate-change goals, asking how their participation in the coalition affected their business practices. Within 10 days, most of the founding members had quit.

Utah Attorney General Sean Reyes, who signed the letter sent to NZIA, said Hild has been vital in his office’s pushback against ESG. “He has helped raise the alarm and armed us with actionable, detailed information,” Reyes said in a statement. (The NZIA is part of the Glasgow Financial Alliance for Net Zero. Michael R. Bloomberg, the founder of Bloomberg News parent Bloomberg LP, is co-chair of GFANZ.)

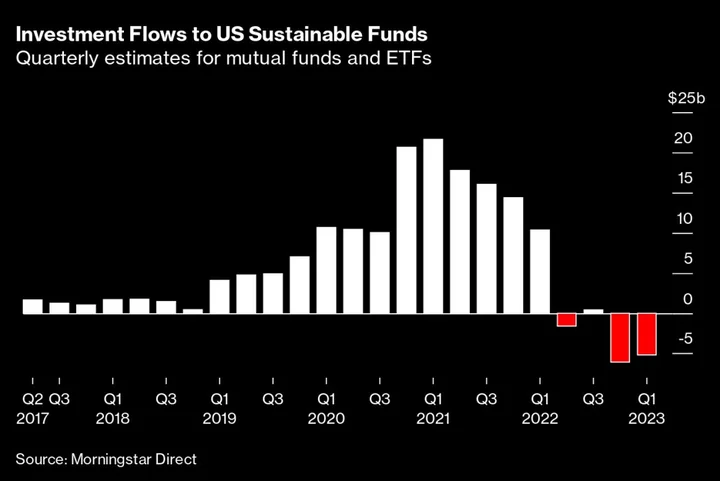

The track record of the anti-ESG forces is decidedly mixed—BlackRock saw several states pull more than $3 billion from its accounts, members of climate-finance groups have fled in droves and investors and bankers are talking a lot less about ESG than they did before. But BlackRock still got $230 billion of net inflows from US clients last year and any impact on money flows into sustainable investments have been hard to suss out, with analysts saying that poor performance was the main driver behind withdrawals from those types of funds.

BlackRock declined to comment.

Born in Knoxville, Tennessee, and raised there and in Florida, Hild is a Georgetown University law graduate who previously worked at conservative groups including the Federalist Society. He first grew annoyed with do-gooder corporations about five years ago, when he saw them taking positions on social issues that seemed completely unrelated to their businesses. Operating at the time from a shared office space, Hild was especially frustrated at seeing single-use plastic cutlery banned from the facility for the supposed environmental benefits, regardless of what clients wanted.It isn’t lost on Hild, whose father is a retired Southern Baptist minister, that ESG traces its roots to strategies employed by religious groups that shun investments like tobacco, alcohol and gambling. He says that’s different from large financial companies imposing liberal goals on customers who may not agree with them. He’s particularly bothered when money managers for state pension funds use their control of retirees’ assets to pressure corporations to adopt ESG policies.

“They have this messianic view of their own purpose,’’ Hild said from his home in Bethesda, Maryland.Hild took over Consumers’ Research in 2020 and counts Leo, who once co-chaired the Federalist Society, as his main financial backer, according to a person with knowledge of the matter who asked not to be identified discussing private matters. Leo’s CRC Advisors, a public affairs firm, also helps with research and polling. Leo didn’t comment about his funding.The same year Hild took over Consumers’ Research, BlackRock’s Fink devoted much of his annual letter to the risks posed by climate change, and discussed the merits of ESG strategies. Hild said he was already agitated after reading online about how ESG funds charge higher fees than traditional funds, and he didn’t like what he saw as liberal talking points promoted by Fink.So in late 2021, Hild and his group began an attack campaign against the world’s biggest money manager. He ran TV and digital ads and organized billboards in Times Square mocking BlackRock and Fink. He also sent letters to 10 governors whose states did the most business with BlackRock, telling them that pensions were at risk from BlackRock’s ESG business and its investments in China.

Soon after, Florida Governor Ron DeSantis lashed out at “woke corporations” and China, and other officials from West Virginia and Louisiana followed with their own attacks.Since then, BlackRock has sought to play down the significance of its ESG commitments, saying it doesn’t boycott any industry and is focused on reducing risks in its investments more than pushing for a particular cause. It’s hired more lobbyists in Washington, mounted an advertising campaign to burnish its reputation and has sent emissaries to lawmakers in Texas and elsewhere, seeking to put them at ease. Fink has said the attacks have become personal, and BlackRock began paying for home security for the CEO to address potential threats.

Other ESG proponents have hit back, saying the attacks are anti-free market, raise borrowing costs for states and could undermine the savings of millions of retirees.

Read more…

- Insurers Quit Climate Club in Droves After Threats From GOP

- World’s Biggest Green Finance Club Rebukes Political Attacks

- BlackRock Struggles to Escape From the ESG Crossfire: Timeline

Hild said he’s only in the early stages of his anti-ESG campaign, and it could run beyond next year’s presidential election. So far, he’s spent almost $10 million on his drive, with nearly half of that used to target BlackRock. Hild said he plans to continue with his attacks against the money manager.For his new campaign against Bank of America, Hild said he has an initial budget of $500,000 that he intends to spend in the coming weeks. Since the bank is a household name—with its tens of millions of customers and thousands of branches across the country—Hild said it's an easier target than BlackRock.“It wraps itself in the flag of America, the idea of freedom and liberty,” Hild said. “Yet it's engaging in all these behaviors that are anti-consumer.”