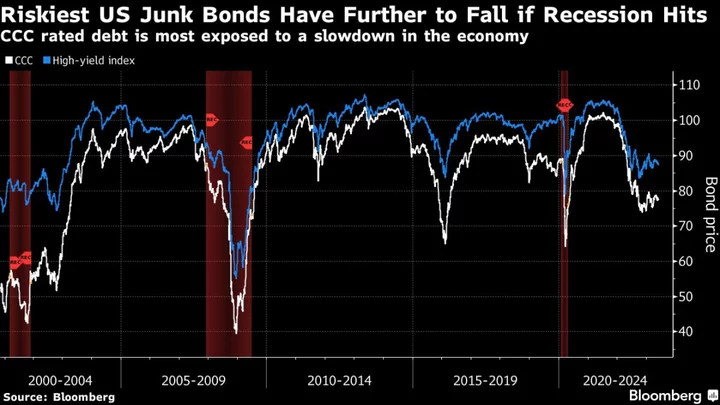

The riskiest corporate bonds are dropping as signs of economic weakness spread, raising the specter of more defaults and distress.

Debt from companies rated CCC — the lowest tier of junk — fell by the most in eight months in May, led by a 23% plunge in Chinese bonds. It’s expected to remain under pressure from rising interest costs, declining earnings and dwindling access to capital as the economies of Europe, China and the US sputter.

“Buying CCCs now is playing with fire,” said Hunter Hayes portfolio manager of the Intrepid Income Fund. “Most CCC situations are destined for problems,” said Hayes, whose firm manages $650 million in assets.

For most of this year, the riskiest debt outperformed as investors snapped up the bonds — which tumbled in 2022 — betting that central banks would swiftly win the war on inflation. But US Federal Reserve and ECB officials maintain rates will stay high for longer, and Friday’s strong US payrolls data support a more hawkish stance.

Tighter monetary policy boosts funding costs, which hits the weakest borrowers hardest. It also puts pressure on consumers and the economy at large, undermining revenue across the board.

High-grade investors are also moving to safer bonds, dumping debt rated BBB which is most exposed to rating downgrades.

“It’s time to take CCC chips off the table,” said Matthew Mish, a UBS Group AG credit strategist. “After second quarter earnings in late July and August, you are going to see a larger wave of downgrades.”

Mish expects returns for CCC debt to be in the negative low single digits by the end of the year. That’s down from a positive return of more than 5% so far this year on the lowest-rated corporate bonds.

CCC debt would be hardest hit by recession and borrowers in that rating category would have the most difficulty raising new money, according to Kyle Kloc, a Zurich-based senior portfolio manager at Fisch Asset Management, which manages about €8 billion ($8.6 billion).

“We have already seen difficulties for companies to refinance due to the sharp rise in interest rates since the start of 2022,” said Kloc. “We certainly do not think now is the right time to be adding more risk to the portfolio.”

Bonds in the lowest rating category are most likely to miss debt payments and end up filing for bankruptcy. Fitch Ratings recently increased its default rate forecast for this year to as high as 5% for US junk, citing tighter lending conditions and reduced access to capital amid banking industry turmoil.

Read more: Deutsche Bank Sees US Leveraged Loan Defaults Peaking at 11%

Another challenge for holders of CCC bonds is finding a buyer when they want to get out, which often aggravates volatility. Riskier junk bonds tend to be smaller and secondary market liquidity generally tends to decline over the summer, making it hard for investors to exit.

“It’s going to be really hard we think to move risk in July or August,” said Mish at UBS.

For more on corporate debt risks, listen to the latest Credit Edge Podcast

Yield seekers may still be tempted, however, given that global CCC rated debt pays more than 14% on average, much higher than where it’s been for most of the last five years. Spreads would have to blow back out above 1,000 basis points — a level that typically denotes distress — before the debt would look attractive, according to Intrepid’s Hayes.

“We are not going to say pile into CCCs today,” said Bradley Rogoff, a strategist at Barclays Plc. “You will see points of wider spreads this year.”

Elsewhere:

- At least three large firms filed for Chapter 11 bankruptcy protection in the US during a single 12-hour stretch, following up on the biggest rush in years.

- Structured credit is the most attractive it’s been in a decade, according to LibreMax Capital Chief Investment Officer Greg Lippmann.

- Companies racing to sell bonds in Europe before a plethora of risks play out fueled the busiest May for issuance on record. Bond sales by companies and financial firms, mostly investment grade issuers, topped €119 billion, according to data compiled by Bloomberg.

- Banks are trying to figure out how to keep holders of a key set of securities happy as they to move away from Libor. Additional tier 1 instruments, coming in the form of preferred shares in the US and contingent convertible bonds in Europe, usually offer fixed coupons for a few years, and then switch to floating rate notes.

- Hong Kong sold the equivalent of $5.96 billion of green bonds across three currencies, Asia’s largest-ever debt offering earmarked for helping the environment.

- Chinese dollar bonds posted their first weekly gain since the end of March, according to a Bloomberg index, even as more downbeat economic data were released. Leading the advance was a unit of Dalian Wanda Group Co., whose notes bounced as the conglomerate mulls asset sales and a possible bond buyback.

- Though Chinese issuers’ offshore-note defaults have slowed from last year’s record pace, such notes are a record 94% of missed bond payments as borrowers focus on meeting domestic debt obligations.

- A moment of reckoning is approaching for Vedanta Resources Ltd. Indian billionaire Anil Agarwal’s miner has $2 billion of bonds due in 2024 — a record annual bill for the company. While the group settled some debts on Wednesday, pricing data indicate investors have lingering concerns about repayments down the road.

--With assistance from Kevin Kingsbury, Bruce Douglas, Catherine Bosley and Nina Trentmann.