It took more than a year for a long-anticipated merger of Vodafone Group Plc and CK Hutchison Holdings Ltd.’s Three to come together. And it could take just as long for the deal to clear the antitrust and national security hurdles to come.

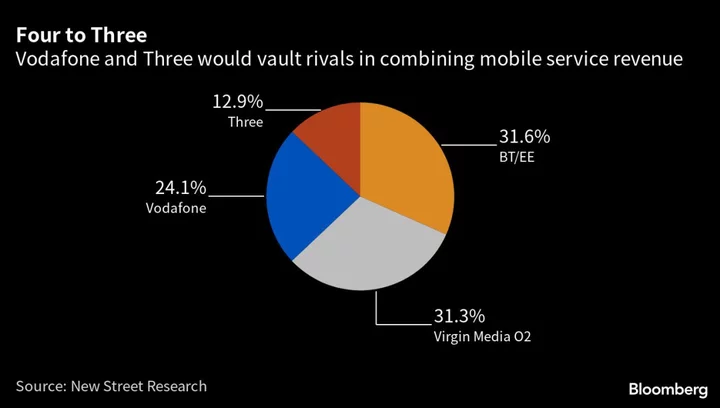

The combination of Vodafone and Three, announced Wednesday, would form the UK’s largest mobile operator by revenue — which in and of itself will prove a tricky proposition to take to Britain’s Competition and Markets Authority. The agency has aggressively tackled antitrust issues in recent months, blocking in April Microsoft Corp.’s $69 billion takeover of game maker Activision Blizzard Inc. — a move that all but halted one of the biggest acquisitions of all time, even as the European Union’s regulator was ready to wave it through.

The Vodafone-Three merger will serve as the next big test of the CMA’s might. Analysts at New Street Research estimate that the antitrust investigation by the CMA and the UK’s communications regulator, Ofcom, could take as long as 18 months.

While the companies’ commitments to improve the nation’s fifth-generation network coverage will appeal to the government, “the real decision-maker here is the fiercely independent CMA, which tends to consider competitive concerns both now and in the future,” said Karen Egan, at Enders Analysis. “The shape of the UK mobile industry is in its rather uncertain hands.”

Vodafone and CK Hutchison declined to comment.

The deal comes at a time when UK consumers are being squeezed by high inflation levels, and less competition for an essential service could lead to higher prices. Yet both companies have struggled to earn back their cost of capital in the country, leading to a sense of urgency to close the deal as the government seeks to show the UK is open for business post-Brexit.

The merger will almost certainly be reviewed by the Investment Security Unit, a new government body that has already blocked several Chinese takeovers since it was established in January 2022. The unit screens the security implications of deals involving sensitive technologies including telecoms and probed French billionaire Patrick Drahi’s move to build a stake at Vodafone rival BT Group Plc.

Blocked Deal

The merger would reduce the number of UK mobile network operators from four to three, a fact that killed a similar deal before. In 2016, Ofcom and the CMA opposed Three’s attempt to buy O2. The CMA ultimately referred the decision to the EU, which blocked it.

Things have changed since then: The UK has left the EU after Brexit, the O2-Three decision was challenged in court and mobile executives are saying the Covid-19 pandemic underscores the importance of strong telecommunications networks even as their share prices have been battered.

Read More: Vodafone, Three Deal to Create Biggest UK Mobile Network

CMA will need to consider the companies’ holdings of mobile spectrum airwaves — a highly-valued, scarce resource they use to transmit signals — as well as their pricing power, wholesale market power and the implications for infrastructure-sharing. The combined company would own about 46% of total mobile spectrum, according to Egan.

The CMA’s veto of the Activision deal led Microsoft President Brad Smith to say the EU was a better place to do business. Following the agency’s ruling, Chancellor Hunt said regulators should “understand their wider responsibilities for economic growth.”

Read More: Tech Companies Warn That UK Is Losing Business Allure

A tough stance may find a more sympathetic audience among labor advocates. The Unite union, which has members but no official representation at the two companies, is campaigning against the merger, citing potential job losses and higher bills.

The deal “will give a company with deep ties to the Chinese state an even more prominent place at the heart of the UK’s telecommunications infrastructure,” the union’s head of operations, Gail Cartmail, said. “The government must step in and stop this reckless merger.”

No Rubber Stamp

Rising geopolitical tensions suggest the ISU won’t be a rubber stamp, either. Although CK Hutchison has invested in UK infrastructure for decades without an issue, its Hong Kong ownership has alarmed some after the Chinese government passed a national security law to assert further control of the former British colony in 2020.

Meanwhile, both Vodafone and CK Hutchison have global relationships with China’s Huawei Technologies Co Ltd and picked it to help roll out their British 5G networks before the government banned it from next-generation wireless systems in 2020.