The UK’s biggest high street bank now owns one of the country’s best-known newspapers — something Lloyds Banking Group Plc had been determined to avoid as it tried to claw back £1 billion of debts from the owners of the Sunday and Daily Telegraph.

The lender finally pulled the plug this week following years of negotiations with the Barclay family — which has owned the newspaper titles since 2004. In recent weeks, the bank had pressed the family to put forward its best plan to shrink the company's debt pile. The response disappointed Lloyds: it included a request for the bank to take a haircut on its loan. The terms were unacceptable to the lender, according to people with knowledge of the discussions who declined to be identified because they weren’t authorized to speak publicly.

Attempts to tweak the offer over the last week failed to impress Lloyds, the people said. In the end the bank ran out of patience with the publisher forcing B.UK, the Bermudian-based holding company for the Telegraph Media Group into receivership on Wednesday. The bank says it now plans to sell the titles, with several possible buyers from rival media groups to wealthy individuals linked with a deal.

Lloyds taking control of some of the nation’s best known titles shocked the media and political world in Britain. It has thrown up questions about the future ownership of the Telegraph newspapers, which have stridently backed both Brexit and the ruling Conservative Party, ahead of a general election expected next year. The dramatic move has turned the spotlight on the family and the rest of its shrinking business empire.

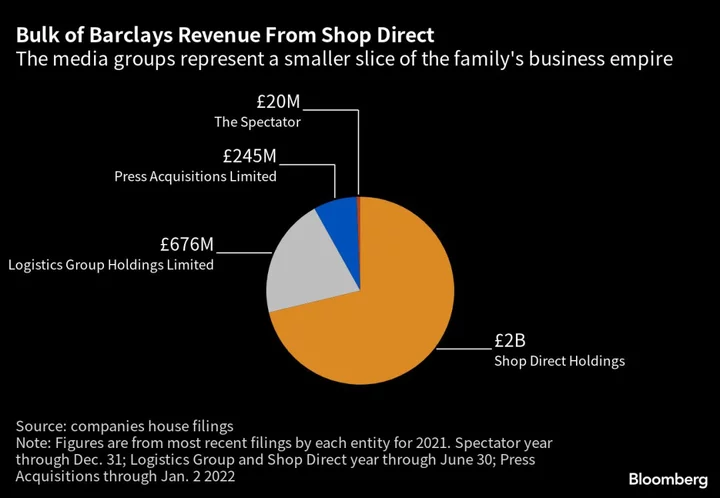

The bank’s intervention might not be the end of it. Sitting in a separate structure from the media assets is the family’s e-commerce business Shop Direct Holdings — the holding company for Very Group — which accounted for most of the empire’s revenue in 2020-21, according to company filings. Lloyds is focusing on the Telegraph titles, but possible solutions to the unpaid debts could involve that part of the business, according to several people involved in the talks. However, they cautioned it would be complicated, with Very having other influential stakeholders, such as Carlyle Group Inc. A spokesman for the US private equity firm declined to comment.

Lloyds has hired AlixPartners and investment bank Lazard to assist in the restructuring, while the Barclay family has been using Houlihan Lokey to examine its options. Representatives at all three firms declined to comment for this story. In a statement on Wednesday, AlixPartners said the publications haven’t entered administration, and their day-to-day running will continue as normal. Though the Barclays have lost control of the newspapers, a spokesperson for the family emphasized that the publications themselves are unaffected by Lloyds’s actions for now.

“The loans in question are related to the family’s overarching ownership structure of its Media Assets,” the spokesperson said. “They do not, in any way, affect the operations or financial stability of Telegraph Media Group.”

For the family, headed by twins Frederick and David until the latter’s death in 2021, it marks a rare and unwelcome appearance on the front pages. In 2021, internal family divisions were laid bare in the Royal Courts of Justice when Frederick Barclay was ordered to pay £100 million to resolve a divorce case. A separate legal action brought by Frederick against other members of the family alleged that some had been using bugging devices to spy on others in the family-owned Ritz Hotel.

In one of their most recent high-profile disposals they sold the Ritz, one of London’s most famous luxury hotels, to a Qatari investor group for almost £800 million in 2020. With the loan to Lloyds already in default at that point, some of the proceeds of the Ritz sale went to the bank, one of the people said. Citigroup was among the other recipients of the proceeds, the person added. A spokesman for the New York-based lender declined to comment.

Change of Banker

Lloyds has financed the Barclays for almost two decades. The loan which triggered the receivership was initially signed off by Peter Cummings, once one of the UK’s most powerful bankers who wrote huge checks for the likes of Philip Green, the Reuben Brothers and the Barclays, who were then among the richest families in the country. Lloyds inherited some of those loans when it bought Cummings’ employer — Bank of Scotland, part of rival HBOS — in a rescue takeover by Lloyds at the height of the financial crisis in 2009.

Within two years, Antonio Horta-Osorio became chief executive officer, taking the bank from the brink of nationalization back to full private ownership inside a decade. The loan to the Barclay family was among the biggest single exposures Lloyds inherited from HBOS, at one point hitting a level of about £1.5 billion, according to a person familiar with the matter. A spokesperson for the Barclay family declined to comment.

Lloyds worked to manage the risk, bringing it down to about £1 billion, writing off much of its value in its accounts and adding conditions to give the bank more security against the debt over time, the person said. That effectively put Lloyds in the position where it could seize the newspapers if necessary, the person said.

Steven Shelley, group chief risk officer, is one of the key people inside Lloyds who has dealt with the loan. Horta-Osorio also discussed the repayment of the loan with Aidan Barclay, chairman of the media group and son of David, on several occasions. Spokesmen for Horta-Osorio, Lloyds and the Barclay family declined to comment, while Shelley didn’t respond.

If Horta-Osorio laid the groundwork, it was his successor, Charlie Nunn, who pulled the trigger. Given the substantial write down Lloyds has already made on the value of the debt, any sale could produce a sizeable benefit in the form of a write-back. Even so, the bank might not get the full value of the loan back.

Divorces and Court Cases

The loss of the Telegraph newspapers represents a major fall from grace for the Barclay brothers. Having grown up with little money, they started their careers in the accounts department of General Electric Co., going on to buy companies others did not want and building a valuable portfolio. By 1993, they had bought their own £2.3 million island, Brecqhou, in the Channel Islands.

Read More: Billionaire Twins Shaking Up Opaque U.K. Business Empire

In 2004, they won a bidding battle and bought the Telegraph, with Aidan Barclay becoming chairman — a job he relished. He took an interventionist approach, for example calling the news desk when former prime minister Margaret Thatcher died in 2013 to ensure the reporting mentioned it happened at the Barclay-owned Ritz Hotel, according to a staff member who worked there at the time who asked not to be identified because they weren’t authorized to speak publicly about the matter. The family was also able to promote its anti-European Union opinions through the newspaper, which over time took trenchant views on Brexit and employed Boris Johnson as a columnist before he became prime minister.

The family business sits within a byzantine structure of offshore trusts in jurisdictions that require little public disclosure. Those opaque entities sit at the top of several of the family’s businesses in the UK, which include The Telegraph, The Very Group and a number of other firms.

A forensic report carried out by accountants at KPMG and submitted as evidence during Frederick Barclay’s trial for contempt in 2022, after he refused to pay the £100 million, offers a picture of the family's empire, where debts have been rising. The report was commissioned by lawyers acting for Barclay’s former wife.

Simon Albrighton, a partner at the accountancy firm, was asked to value loan notes issued from one offshore Barclay’s family trust and held by another to assess the ability of Frederick to pay the money he owes as part of the divorce settlement. A lack of disclosure about the chain of companies that hold the Barclay’s assets made this job impossible, the accountant concluded in the report.

“I have not received any financial information, nor have I been able to identify such financial information publicly, in respect of the offshore parent companies of the underlying businesses,” Albrighton wrote in the report, obtained by Bloomberg from a court filing. “As a result, I am not able to assess the financial position of the business empire as a whole.”

The report also identified a steadily increasing level of indebtedness at the operating companies which had risen to nearly £2.5 billion by 2019 from £1.6 billion in 2010. The spokesperson for the Barclay family declined to comment on the figures.

Shop Direct Holdings, the holding company of the Very Group, and the largest business the Barclays own, was owed a significant amount of money by its offshore parent company, Albrighton noted in his report.

Deciphering the state of the Barclay's financial affairs is further complicated by a web of loans between companies tied to the family. The owner of delivery service Yodel has been owed funds in the past from a Very Group unit, but also from a London-based property management business controlled by the Barclay family. In addition, Aidan Barclay has loaned funds to Shop Direct Holdings, and had £123 million outstanding at the end of June 2021 that was later repaid to him in full, according to UK registry filings.

Suitors Circling

A sale could still be months away. Lloyds’s team of receivers are now going through the inner workings of the Barclay’s publishing business to understand the details. A new buyer of a major national newspaper would likely be subject to a government antitrust review.

Meanwhile, staff at the newspaper were this week playing down the impact of the turmoil. In an email to staff, the Telegraph Media Group’s CEO Nick Hugh said he did not “anticipate any operational or staff changes.” In a separate email, Daily Telegraph editor Chris Evans said, “there's every reason to be optimistic whatever the outcome.”

With the fate of the newspapers uncertain, it took Matt — the newspaper’s longstanding cartoonist — to inject some gallows humor. “I hear we're going to be bought by Prince Harry,” his daily cartoon quipped. “He's always been interested in journalism.”

--With assistance from Jonathan Browning, Harry Wilson, Sabah Meddings, Conrad Quilty-Harper and Thomas Seal.

Author: Katherine Griffiths, Lucca De Paoli, Irene Garcia Perez and Benjamin Stupples