Thailand’s central bank raised its benchmark interest rate to the highest level in eight years to anchor inflation expectations more firmly in an economy on track for faster expansion amid a rebound in tourism.

The Bank of Thailand’s Monetary Policy Committee voted unanimously to raise the one-day repurchase rate by 25 basis points to 2% on Wednesday, as seen by 22 of 24 economists in a Bloomberg survey, with two predicting no change. The key rate was at 2% back in January 2015.

Although headline inflation has eased every month since January, returning within the BOT’s 1%-3% target in March, the central bank has emphasized the need to keep price gains in check over time. The key risks are increased consumption from a tourism-led pickup in economic activity and possibly higher spending by a new government following the May 14 election that saw several populist political pledges.

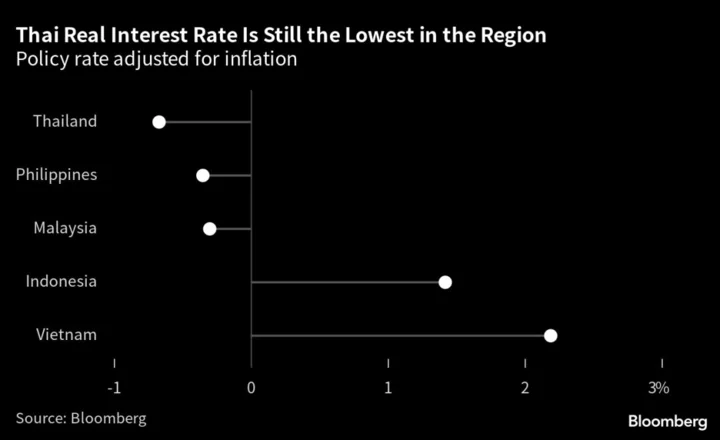

Wednesday’s tightening will help narrow Thailand’s real interest rate to a negative 0.67% from 0.92% previously — still making it Southeast Asia’s lowest after adjusting for prices.

The Thai baht has weakened about 1.5% in the past month, while foreign investors turned net sellers of local bonds and stocks on concerns about possible delay in formation of a new government, which will affect budget spending and investment.

--With assistance from Tomoko Sato, Pathom Sangwongwanich and Anuchit Nguyen.