Rising household debt is a “time bomb” awaiting Thailand’s new government, and the problem will likely be more apparent when the ongoing economic recovery loses momentum, an official said.

“It’s like a ticking time bomb that can explode later,” Danucha Pichayanan, secretary-general of the National Economic & Social Development Council, said Monday. “The next government needs to closely monitor and make it a priority to fix the problem.”

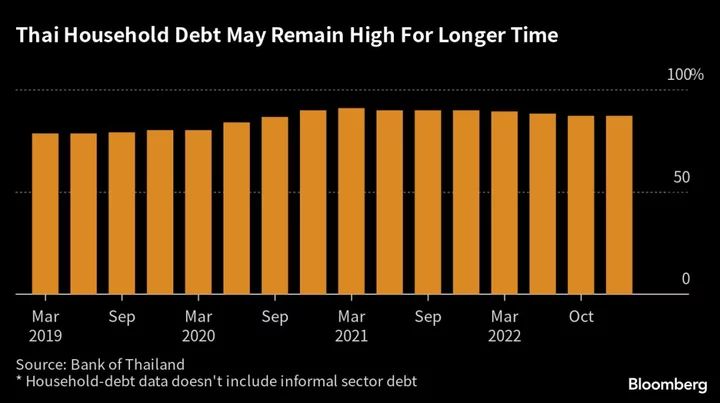

Household debt has always been a pain point for Thailand as it weighs on consumer spending and economic growth. At the end of 2021, it totaled 15.1 trillion baht ($438 billion), or 87% of gross domestic product. The ratio already dropped from about 91% of GDP during the pandemic as the economy expanded, but it continues to climb to new record in terms of value.

Bad debts and personal loans of those affected by the pandemic are still rising. As such, the new government must continue to support debt restructuring measures and financial discipline for individuals as well as control campaigns that will promote more debts, Danucha said.

A number of populist policies in the past have also led to rising household debt as the government encouraged borrowing to help stimulate the economy. These include a steep tax rebate in 2011 to 2012 for first time car buyers, implemented by former Prime Minister Yingluck Shinawatra and which was meant to boost consumer demand following the nation’s biggest flood.