Texas Instruments Inc. gave a disappointing revenue forecast for the current period, indicating that demand remains sluggish for a broad range of electronic components, including industrial equipment.

Revenue in the fourth quarter will be $3.93 billion to $4.27 billion, the company said Tuesday. That compares with an average analyst estimate of $4.49 billion. Profit will be $1.35 to $1.57 a share, versus a prediction of $1.76.

The outlook, which sent the shares down 4.7% in late trading, bodes poorly for a chip industry trying to recover from a punishing slowdown. Texas Instruments has the broadest list of customers in the semiconductor industry, making its forecasts a bellwether for demand across the economy. The largest portion of its revenue comes from makers of industrial machinery and vehicles.

Car components remain a bright spot for the Dallas-based company, but other areas aren’t rebounding as quickly as hoped. “During the quarter, automotive growth continued and industrial weakness broadened,” Chief Executive Officer Haviv Ilan said in a statement.

Chip investors have been waiting for signs that electronics makers have worked their way through a pileup of inventory and are ready to increase orders again. They’ve been especially pessimistic about Texas Instruments this year.

Even as shares of other chipmakers rebounded, Texas Instruments stock has fallen 11% in 2023. That’s made it one of the worst-performing members of the the Philadelphia Stock Exchange Semiconductor Index.

The latest report also weighed on shares of other chipmakers. Analog Devices Inc. fell as much as 3%, while On Semiconductor Corp. dipped 2.5%.

Texas Instruments’ revenue in the third quarter declined 14% to $4.53 billion, compared with an average estimate of $4.55 billion. Profit was $1.85 a share, versus a prediction of $1.82. For the year, revenue is on course to drop 10%, according to analysts’ projections. That would break a three-year run of sales growth.

As it copes with the slowdown, Texas Instruments has argued that its products have a long shelf life — up to a decade. That means an accumulation of inventory is less of a problem than for other chipmakers, and it may even help the company respond more rapidly when demand returns.

Even so, Texas Instruments has slowed down operations at some factories to guard against building up an excess of unused parts. But not running its plants at full capacity is taking a toll on profitability and will require the company to take charges in the current quarter, according to Chief Financial Officer Rafael Lizardi.

He refused to speculate on when demand might bounce back. The Chinese chip market also has been weaker than hoped, the company said. An expected return to post-pandemic spending hasn’t materialized in that country.

There are concerns about the automotive market as well. Though it’s been holding up for Texas Instruments, strikes at US plants by the United Auto Workers could ultimately threaten demand.

“In the automotive space, at the end of the day, no one knows what’s going to happen,” Lizardi said. “Could the UAW situation put a dent in demand? Of course.”

But the average age of cars on the road has risen, meaning that — at some point — there will be demand for new vehicles, he said. And new vehicles have an increasing number of electronic functions that need chips to support them, Lizardi said.

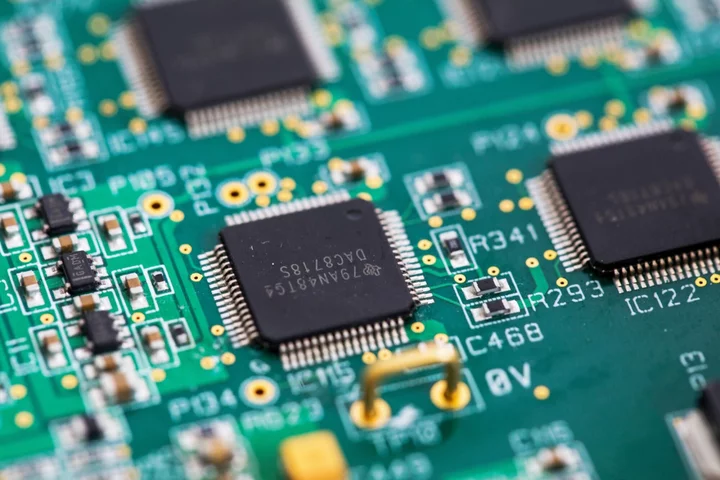

Texas Instruments is the biggest maker of analog semiconductors — chips that perform simple but vital functions, like registering button presses and detecting changes in temperature. They also control motors in everything from rockets to domestic appliances. Such chips generally require less advanced production techniques than digital products.

Up until this year, Texas Instruments had been a favorite of long-term investors, who applauded its commitment to returning cash to them in the form of dividends and buybacks. More recently, it’s been spending money on new factories, aiming to increase the amount of manufacturing it does in-house. That could give it an advantage in the future, but it’s expected to weigh on free cash flow in the short term.

Texas Instruments spent $1.5 billion on capital expenditures last quarter, up from $790 million in the same period a year earlier. The chipmaker will continue its investments and has budgeted $5 billion a year for new plants and equipment until 2026, Lizardi said.

“Why pull back now because we’ve had a few quarters of downturn?” he said. “We have the cash. We have the balance sheet. Over the long term, owning your own manufacturing makes sense. You control your own destiny.”

(Updates with CFO comments in 12th paragraph.)