Investors are turning more wary on Tencent Holdings Ltd. hours before China’s most valuable company reports quarterly results.

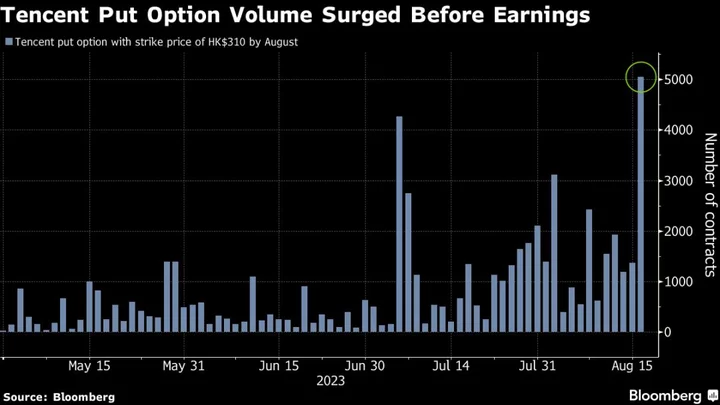

A put option betting the stock will drop 6% from now until the end of August is the one of the most popular contracts traded in Hong Kong on Wednesday. That marks a sharp contrast to just a day before, when three of the top ten most traded options in the city were bullish calls on the online gaming giant. Tencent’s stock fell as much as 1.5% ahead of June quarter earnings due later in the day.

The company is expected to record strong net income growth, thanks to on-track online gaming revenue and advertising improvement from a low comparable base. Still, analysts cautioned that any rally driven by an earnings beat could be overshadowed by economic concern.

The technology sector has been sold heavily in recent weeks as investors dump Chinese stocks amid concerns over the onshore credit crisis. Tencent’s peer Alibaba Group Holding Ltd. is down more than 4% after announcing an earnings beat last week.

Alibaba Takes Step Toward Comeback as Growth Finally Returns

Instead of purely buying a call option, JPMorgan Chase & Co. in July recommended creating a call spread to position for a potential earnings beat for Tencent, through buying a call option with a strike price of HK$360 and selling a call option with strike price of HK$390. The spread essentially bets Tencent shares would not rise beyond the upper end after results.

“We find the stock was range-trading one month into the event, reflecting caution on the macro environment,” said JPMorgan analysts including Xipu Han in a note. “While we think implied volatility in Tencent is fairly priced, we think it would be difficult to carry outright long call positions should the range-bound trading pattern repeat.”