China’s tech and consumer earnings stood out in an otherwise disappointing results season, emerging as pockets of resilience that can help equity markets turn a corner as stimulus measures kick in.

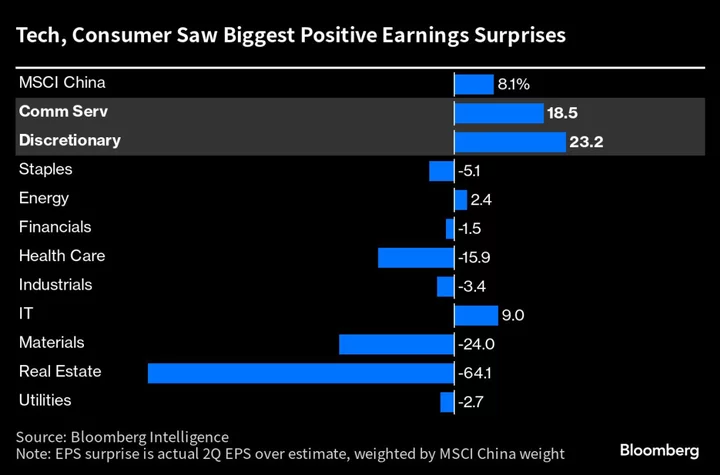

Members of the MSCI China Index delivered an 8.1% positive earnings surprise for the April-June quarter as the communication services and consumer discretionary sectors helped offset disappointments elsewhere, notably at troubled real estate firms, data compiled by Bloomberg Intelligence show. The performance of the two sectors is crucial given that they account for about half of the MSCI gauge’s weight.

E-commerce firms such as Alibaba Group Holding Ltd. and PDD Holdings Inc. are among those that saw broadly better-than-expected results as they successfully catered to the pent-up demand from consumers following the removal of pandemic curbs. Big spending on food, travel and movies has spurred optimism that underlying demand can gather momentum and support a budding recovery in Chinese stocks after a series of market-boosting measures in recent days.

READ: China Stock Investors Pin Hopes on Revival After Brutal August

“We expect short-term sentiment improvement, while more sustainable results may hinge on a demand boost and further measures to address structural issues,” wrote Morgan Stanley strategists including Laura Wang in an Aug. 31 note. “Consensus earnings estimate revisions breadth showed early signs of acceleration.”

New stimulus measures have been coming on an almost daily basis over the past two weeks, including the first reduction since 2008 in the stamp duty for stock trades and a cut to existing mortgage rates. While not enough to dispel deeper worries over China’s structural economic slowdown and the property market’s relentless troubles, the measures have nonetheless helped lift sentiment.

The benchmark CSI 300 Index rose 2.2% this week following a rout through most of August. Meanwhile, forward earnings estimates for MSCI China members have climbed 0.6% from this year’s low at the end of June, according to data compiled by Bloomberg.

“We already had high expectations before the earnings results, and the results slightly exceeded that expectation,” said Jian Shi Cortesi, a fund manager at GAM Investment Management. “When investors start to focus on company fundamentals, these shares can perform better,” she said.

READ: China Stocks Find a Floor as Policy Steps Ease Market Angst

Tech Shines

The tech sector’s earnings per share rose 35% from a year ago in Hong Kong dollar terms, according to Bloomberg Intelligence. That helped trim the overall decline in EPS for MSCI China members to 8.6% versus a drop of 4% in the first quarter.

Communication services and consumer discretionary sectors, which include some of China’s largest tech firms, delivered earnings surprises of about 19% and 23% respectively. Materials and real estate industries saw disappointments of double-digit percentages against estimates.

China’s internet leaders were relatively freer to pursue growth in 2023 after more supportive rhetoric from Beijing, signaling regulators were relaxing policies put in place earlier to constrain what they termed a disorderly expansion of capital by the private sector.

It wasn’t all positive, however. Meituan’s shares plunged the most in three months after executives warned that their main food delivery business may decelerate this quarter as economic pressures take a toll.

READ: China Ramps Up Campaign to Boost Fragile Economy, Currency (2)

Even with a slew of upbeat earnings, the stock market isn’t yet out of the woods. China’s economic recovery remains a concern with manufacturing activity staying in contraction in August. The property sector is showing fresh signs of distress as liquidity woes push major developers like Country Garden Holdings Co. to the brink of default.

“We expect profit growth disparity to stay wide within various sectors and themes,” said Marcella Chow, global market strategist at JPMorgan Asset Management. She continues to see downside risk to the consensus 2023 MSCI China earnings growth forecast of 14% amid the wave of soft macro data and property market stress.

Yet some big emerging markets money managers sense the tide is turning. GQG Partners Emerging Markets Equity Fund, a top-performing fund that sold off its China internet holdings last year, is slowly rebuilding the exposure, citing improved earnings and Beijing’s friendlier policy toward private enterprise as reasons.

“With the exception of real estate, China second-quarter earnings have generally been better than expected, largely driven by tech,” said Marvin Chen, an analyst for Bloomberg Intelligence. This, “along with recent policy support suggests the worst is behind us,” he added.

READ: Veteran Stock Picker Says China Risk-Reward Incredibly Favorable

--With assistance from Jeanny Yu, Jane Zhang, Sarah Zheng and Zheping Huang.