Syngenta Group’s delayed initial public offering doesn’t bode well for new listings in Asia for the remainder of the year.

The Chinese-owned seed giant on Thursday postponed its Shanghai IPO to the end of next year, citing market volatility. The announcement highlights a general malaise in first-time share sales in Asia, and follows China’s securities regulator’s decision in late August to slow the pace of IPOs, amid an economic downturn that’s been weighing on investors.

Even in Japan, where IPO proceeds are up 167% for the year, a listing application for Rakuten Securities was withdrawn this week, for the time being. The offering was pulled despite parent Rakuten Group Inc.’s growing need to raise funds with losses at its mobile phone carrier business adding up.

If interest rates hikes stop, there may be “revived interest” for large offerings by Asian companies, according to Ke Yan, the head of research at DZT Research in Singapore. Some listings in the pipeline potentially for next year are Bytedance, Sinopec Marketing and CR Renewable Energy, he said.

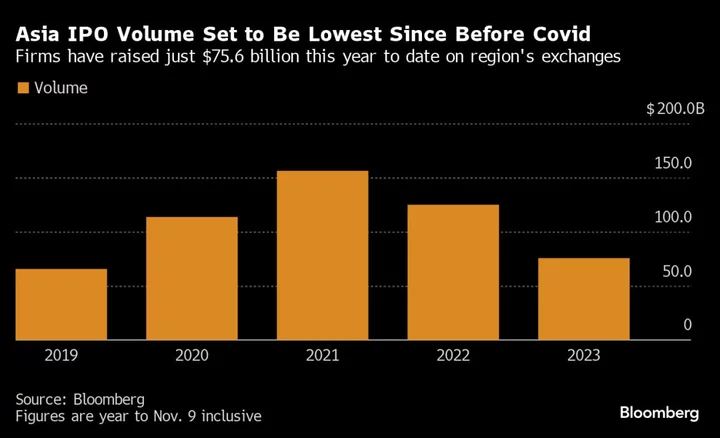

China has been the main source of big-ticket listings in Asia this year, with eight of the top 10 taking place in the country. IPOs in mainland China have raised $53 billion in 2023, down 37.6% from the same period in 2022, according to data compiled by Bloomberg. That’s in line with the nearly 40% year-on-year drop in volume in Asia as a whole.

Syngenta’s $9 billion IPO would have been the largest listing of 2023, beating Hua Hong Semiconductor Ltd.’s July offering in Shanghai, which raised nearly $3 billion.

Sumeet Singh, head of equity research, IPOs and placements at Aequitas Research in Singapore, said he doesn’t think Syngenta can get such a large deal away at the moment. “I wouldn’t say that it would never happen,” he added.

Asia is not alone, as IPO markets have disappointed elsewhere. Europe’s brief IPO revival is fading as a flurry of deals including CVC Capital Partners, one of the region’s biggest private equity firms, have been delayed amid valuation discrepancies.

High-profile Asian IPO candidates may take a while to come to market. Alibaba Group Holding Ltd.’s logistics arm Cainiao Smart Logistics Network Ltd. was the first among the tech giant’s units to file for an IPO since it said it would split into six entities. The company is expected to raise at least $1 billion, Bloomberg News has reported, however after filing in September, it has yet to launch and will need to seek approval from the exchange.

The Chinese securities regulator said its move to slow the pace of IPOs was aimed at maintaining market stability, adding that some companies have withdrawn IPOs recently due to declining performance and a lack of stable ownership. The CSI 300 Index is down 6.7% so far this year.

Earlier on Thursday, Syngenta also reported a third-quarter Ebitda of $300 million, down 68% from a year ago.

(Adds details on Rakuten Securities’ pulled IPO in third paragraph)