Office developers in eastern Europe are setting their sights on projects far from their bread and butter like luxury Swiss chalets to escape tough conditions at home, increasing pressure in already crowded markets.

Warsaw-listed Globe Trade Centre SA, one of the pioneers of eastern Europe’s office and retail development, embarked on a radical shift last week by unveiling plans to acquire Ultima Capital SA, a developer of high-end vacation homes including a luxury villa on the Greek island of Corfu and several houses in the Swiss Alps. That came shortly after Krakow, Poland-based developer of office buildings Cavatina Holding SA set up a unit building residential homes for rent, saying it wants to create 10,000 over the next 5 years.

The trend to branch out applies elsewhere in eastern Europe, with office developer HB Reavis Holding SA saying in late February it’s ceasing investments in its domestic market Slovakia and southern neighbor Hungary. Instead, it’s going to focus on the UK, Germany and Poland.

The moves could have repercussions beyond Poland and Slovakia as eastern European developers compete with firms from Sweden to Germany and the UK over the slices of the market still seen as safe and lucrative. They also come against the backdrop of downturns across commercial real estate in much of Europe.

Read More: Why a Crisis Is Looming in Commercial Real Estate: QuickTake

The strategic revamps are some of the starkest indications yet how much eastern European developers are rethinking their way of operating now that era of cheap money is over. Business models crafted during times when valuations were only going up are in dire need of overhaul.

The reversals are particularly stark in the market for office space given the strong past performance as a large number of companies outsourced corporate functions to the region to benefit from comparatively low costs for skilled labor. The industry is now facing rising vacancies as remote work has become more popular and many buildings are in need of expensive renovations to meet ever stricter sustainability requirements.

HB Reavis’s move to focus on foreign markets was a response to the “challenging macroeconomic environment, marked by persistent inflationary pressures, rising interest rates, and currency depreciations in all markets where we operate,” the company said in its Feb. 28 release.

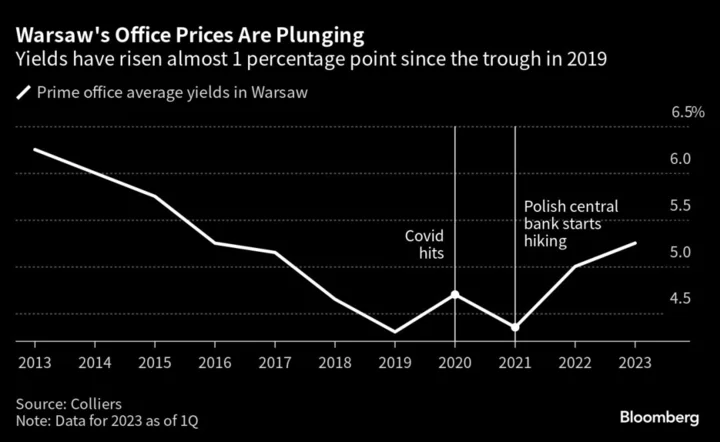

Last year, Warsaw’s office property yields — which move inversely to valuations — rose the most in 14 years last year and continued to increase last quarter.

Before the pandemic hit and central banks subsequently started hiking rates, “local developers could simply wait, do nothing and post gains every year from revaluations” as interest rate declines pushed down real estate yields, GTC Chief Executive Officer Zoltan Fekete said in an interview to explain the planned Ultima takeover. “Such time has gone already and we needed to react.”

Read More: Polish Developer GTC Falls on Surprise Swiss Chalet Move

Its decision to expand beyond office buildings in places such as Warsaw, Budapest and Belgrade into high-end chalets in the Swiss mountains and mansions dotted along the Greek coast is arguably the most drastic change.

On its website, GTC says it seeks to create “office and retail spaces that help people lead better and more balanced lives,” while Ultima says it caters to the elite by providing places that are “as private as a yacht on the Atlantic.”

The rich have “a growing demand for ultra-luxury hospitality with significant privacy,” Fekete said. “Major hospitality operators are lacking solutions.”

Not everyone is on board with the plan. The move is “quite surprising” given GTC’s lack of experience in the luxury hotel segment, BOS Bank SA analyst Maciej Wewiorski said. Some of shareholders might be “puzzled” by the deal.