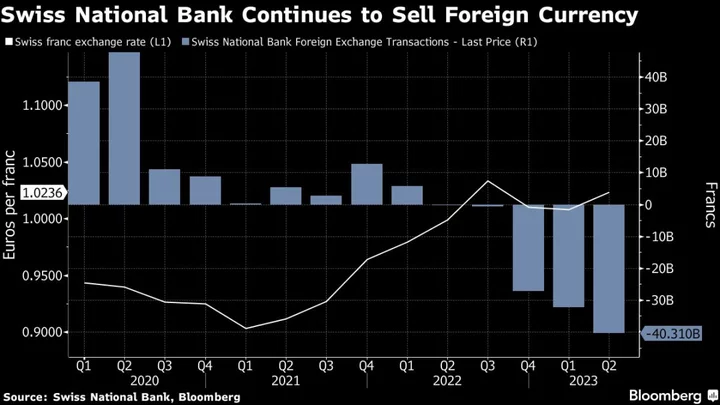

The Swiss National Bank extended its foreign-exchange sales in the second quarter, as it continued to sell other currencies for francs in fighting inflation.

Switzerland’s central bank cut its balance sheet by the equivalent of 40.3 billion francs ($44 billion) from April through June, up from 32.2 billion francs in the first three months of the year. By selling foreign exchange it strengthened its own currency and used it as a firewall against imported inflation.

After more than a decade of buying foreign currencies in an effort to control the franc’s strength, the SNB changed tack last year in sight of the global inflation surge. Partly fueled by those interventions, the franc has rallied some 8% since then, and now is below parity versus the euro.

Economists see the balance sheet as relevant second monetary-policy tool for the SNB, complementing interest rates. After surprisingly stopping to raise those last week, the central bank still maintained that “in the current environment, the focus is on selling foreign currency.”

The institution only publishes foreign-exchange transactions with a delay of three months, so its more recent currency interventions will remain secret until the end of the year.