Bright spaghetti-like strands jiggle across a conveyor belt at a manufacturing plant in Grenchen, Switzerland, before arching into a cutting machine that spits a shower of yellow pellets into an industrial-sized sack.

Nick Hayek, the 68-year-old chief executive officer of Swatch Group AG, reaches in and pulls out a handful. “Look, they’re still warm.”

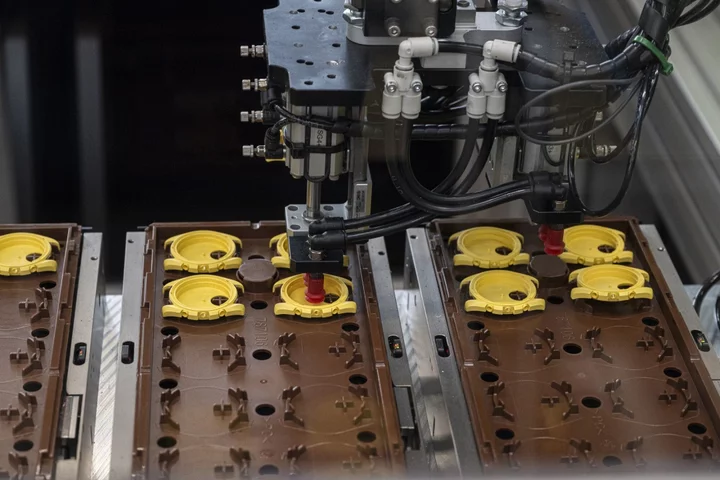

The pellets, made of a material that Swatch calls bioceramic, will soon be heated again and injection-molded to create cases for what is currently one of the most sought-after watches on the planet — the Blancpain X Swatch Bioceramic Scuba Fifty Fathoms.

The launch of the $400 automatic timepiece, a collaboration between the entry-level Swatch brand and the ultra-luxury marque Blancpain, prompted long lines and sold-out stock at Swatch stores when it debuted Sept. 9. The CEO reckons the new watch will help drive Swatch brand revenue to a record next year, surpassing 1 billion francs ($1.1 billion) for the first time.

Hayek, whose late father, Nicholas Hayek Sr., is often credited with saving the Swiss watch industry from the quartz crisis of the 1980s with the introduction of accessible Swatch watches, wants to make clear that the new timepiece isn’t made of plain old plastic.

Rather, bioceramic is a new and proprietary substance unlike the plastic traditionally used to make the brand’s watches, he said. It’s the same material used in the wildly successful MoonSwatch — a tie-up between Swatch and the Omega brand’s legendary Speedmaster chronograph that sold more than a million units last year.

The CEO went so far as to produce a patent application filed with the World Intellectual Property Organization, titled “Article Made From a Heavy Plastic Material,” that details the compound.

“Without the patent and this innovation of bioceramic we would not have done these collaborations,” Hayek said, referring to the MoonSwatch and the joint effort with Blancpain, which have helped revive the fortunes of the Swatch brand. Swatch Group owns both Omega and Blancpain.

The patent application reveals that bioceramic does, in fact, contain polymer material — technically plastic. However, it accounts for less than half of the compound and is made from castor oil derived from plants, rather than petroleum. Ceramic powder, similar to what’s used in dental work, accounts for at least half of the compound, the patent filing shows.

Swatch says the ceramic improves the feel of the watch case and makes it more durable, while the castor-oil-based polymer gives it the flexible characteristics of plastic.

Hayek said he’s been contacted by automakers expressing interest in using bioceramic in luxury vehicles in place of traditional plastics. The Swatch CEO wouldn’t identify the car companies and said it’s unlikely the watchmaker would provide the material.

The launch of the MoonSwatch drove an increase in demand for the $7,000 Omega Moonwatch and other Speedmaster models, with sales in its own boutiques jumping by 50%, according to the company. Now Swatch Group hopes Blancpain timepieces, priced at $10,000 and up, will similarly benefit.

The once mighty brand lays claim to producing the first watch specifically for divers, in 1953. But its models have since been overshadowed by rival offerings, including Rolex’s Submariner and Omega’s Seamaster, the watch now worn by the title character in the James Bond films.

“The primary beneficiary here is Blancpain, aiming to capitalize on Swatch’s extensive reach,” Tim Stracke, the CEO of Chrono24, the biggest dedicated watch trading platform, said in a post on LinkedIn. “Given that the brand’s performance has been less than stellar, they might be open to some MoonSwatch-inspired publicity.”

The collaborations have already boosted demand for other Swatches, according to Hayek, who said sales — excluding the MoonSwatch and Scuba Fifty Fathoms — have increased by 20% to 30%.

The new watch isn’t without detractors. Critics online and in YouTube videos have complained that $400 is a hefty price for a plastic watch — hence Hayek’s effort to clarify the composition of the material. The use of an automatic movement that can’t be serviced — Swatch’s Sistem51 — has also drawn social media scorn.

Hayek said the movement can be replaced if a customer has an issue and components from the used movement will be recycled.

Swatch is already preparing for another collaboration, most certainly made of bioceramic. Hayek wouldn’t say whether it would be another brand under the Swatch Group umbrella, such as Breguet, Tissot or Harry Winston, or something else.

“We have created a new market,” Hayek said of the Swatch collaborations. Other brands have seen “there is an opportunity to reach the younger people without harming your own image,” he said.

--With assistance from Julius Domoney.