The PGA Tour and Saudi Arabia-backed challenger LIV Golf avoided calling their proposed partnership a merger. But their shock announcement is already raising serious concerns with US and European antitrust enforcers, according to people familiar with the matter.

The tie-up, which was announced Tuesday, is being viewed by officials as a brazen play loaded with red flags, not the least of which is creating a giant monopoly in an industry that had only recently gained a competitor, said the people, who asked not be identified discussing non-public matters.

After nearly a year-long acrimonious legal battle, the rival golf leagues said they would join with the DP World Tour, the European golf circuit, and combine their golf-related business and rights into a new commercial entity. The agreement will resolve the ongoing antitrust litigation between PGA and LIV, though final terms of the deal, including the finances, are still in the works.

The new for-profit entity involves three of the biggest golf tours in the world proposing to coordinate key aspects of their business on which they currently compete, the people said.

Competition enforcers are likely to want to know how the proposed partnership will impact players, sponsorships and broadcast rights, they said. The US and United Kingdom — where DP World Tour is based — are certain to ask questions and the European Union’s competition authority may want information as well, they said.

The US Justice Department, which has already been investigating PGA Tour over its dispute with LIV, will review the proposed deal, the people said, rather than the US Federal Trade Commission, which often handles sports leagues.

The DOJ has interviewed several golfers who were suspended by the PGA for joining the rival tour as part of the existing investigation.

The UK’s Competition and Market Authority has established itself as a global player in the competition world following the UK’s exit from the EU. The agency is already investigating sports broadcasters, including Comcast Corp.’s Sky Group Ltd., over the broadcasting of sports content in the UK.

The European Commission, the EU’s competition body, previously brought a case against the International Skating Union over its eligibility rules for speed skaters. Europe’s highest court is also considering a case on whether soccer’s governing bodies, UEFA and FIFA, can restrict players from participating in rival leagues.

A European Commission spokesperson said that if the deal has an EU component, it’s up to the companies to notify the deal. Representatives for the Justice Department, the FTC and the CMA declined to comment.

Antitrust Lawyers

No antitrust lawyers were involved in the PGA-LIV discussions, which focused on how to innovate the sport and bring the game to younger audiences, according to another person familiar with the talks.

The leagues don’t expect the deal, described as a joint-venture, to require a traditional merger review, said that person, who spoke anonymously to describe confidential negotiations. The three tours have a written agreement, with some aspects still being determined, the person said.

Those details are going to be key to the Justice Department’s review of the deal, antitrust experts said.

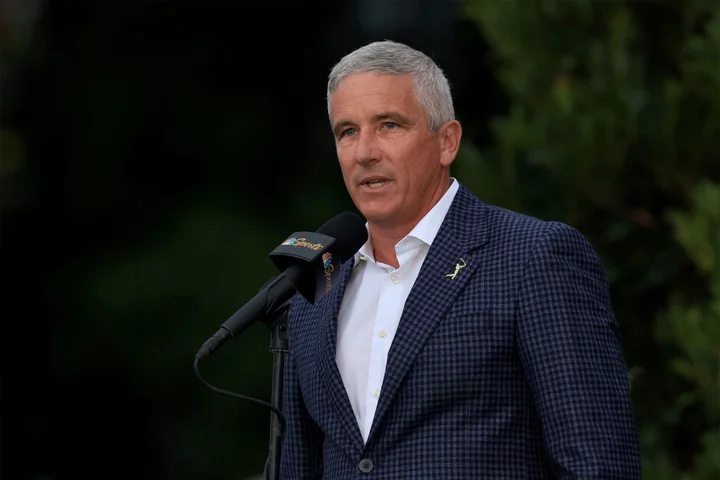

PGA Tour Chairman Jay Monahan dismissed questions about possible antitrust concerns with the partnership.

“Every single player in men’s professional golf is going to have more opportunity and more growth,” he said in an interview with CNBC. “We are going to grow our industry. This is all positive.”

Not everyone agrees.

“The PGA-LIV merger is another in a long line of successful efforts by entrenched monopoly organizers of sporting competitions to maintain their dominance through predatory behavior directed toward rivals, followed by swallowing them up,” said Stephen Ross, a professor at Penn State Law. “Jay Monahan is no different than John D. Rockefeller, putting independent gas stations out of business and then folding them into Standard Oil.”

Still, without knowing the details of the agreement, it’s hard to predict how the Justice Department will come down, said Ross, who is executive director at the Penn State Center for the Study of Sports in Society. For example, provisions that might prevent golfers from playing on a new tour might be cause for concern, he said.

The agency’s antitrust lawyers might request changes or tinker with some of the specifics, said Jodi Balsam, a professor of sports law at Brooklyn Law School. But ultimately, she predicted, the partnership is likely to go ahead.

“People don’t want to see this battle continue, including the regulators — they want to see golfers compete with each other without any barriers,” said Balsam, a former lawyer for the National Football League.

Even if the PGA and LIV argue that the deal isn’t a merger, but a partnership, that may not matter to the Justice Department. It recently won a challenge against an alliance between American Airlines Group Inc. and JetBlue Airways Corp. by arguing it was a “de facto merger.” American plans to appeal the decision, which calls on it to unwind the partnership.

The law firm Wachtell, Lipton, Rosen & Katz, whose Ed Herlihy serves as chairman of PGA Tour’s policy board, is advising the tour on the deal, but LIV wasn’t represented by outside counsel during the discussions. All three of the Wachtell lawyers on the team, including Herlihy, focus on mergers and acquisitions, not antitrust.

Professional sports league mergers are rare. The last major one in the US occurred in 1979 when the National Hockey League voted to incorporate the World Hockey Association’s franchises. Hockey, like other team sports such as basketball, football and baseball, are organized as associations, or joint ventures, that set rules for territories, players and TV and radio contracts.

Only Major League Baseball enjoys an exemption from US antitrust laws, which was granted by the Supreme Court more than a century ago.

Read more: Baseball Exemption Should Be Read Narrowly, DOJ Says in MLB Case

In comparison, in sports like golf and tennis, where individual players compete in tournaments, a single entity like PGA often sets rules for participation. A recent spate of US antitrust cases in sports, however, have focused on how rivalry between single-player leagues impacts players.

In the early 2010s, Ultimate Fighting Championship owner Zuffa LLC – now owned by media company Endeavor Group Holdings Inc. – bought its biggest mixed martial arts rival, Strikeforce. While the FTC didn’t challenge the deal, a group of fighters later filed suit, arguing the merger has allowed UFC to pay a fraction of what it would have in a more competitive market.

The suit remains pending after a federal judge granted class-action status in 2020 to about 1,200 mixed martial artists.

Another antitrust suit, brought by several Olympic gold-medal athletes against swimming’s governing body over rules that barred them from participating in a new swim league, was dismissed by a California federal court in January.

--With assistance from Samuel Stolton.

Author: Leah Nylen, Malathi Nayak and Erik Larson