For equity investors transfixed by a debt-ceiling standoff that risks pushing the US government into an unprecedented default, an analytical principle tied to insolvency is working like a charm.

The more debt a company uses to finance its operations, the worse off its shares have done this month. The momentum picked up this week as tensions in Washington mounted, leaving a basket of stocks with the lowest leverage on track for its second-best month since March 2020 relative to a basket of firms with the riskiest balance sheets.

The divergence reflects growing concern about potential market chaos should the White House and Congress fail to increase the debt cap before early June, when Treasury Secretary Janet Yellen has said her department may run out of cash. While the entire stock market is likely to take a hit should the worst-case scenario materialize, companies with the strongest finances stand to suffer less.

“During times of uncertainty, you often go where you feel the most comfortable,” said Michael Matousek, head trader at US Global Investors. “That’s what we’re seeing in the stock market right now. For some people, being in a blue-chip or safe-haven company provides a much-needed sense of safety.”

Of course, it’s not all about the debt limit. Speculation that the Federal Reserve will raise interest rates further is also worrisome for companies with loans to repay and potentially roll over.

But the impasse in Washington has captivated Wall Street recently, depressing investor sentiment. While performance charts hardly scream outright danger — the S&P 500 Index just logged its highest close of 2023 — the stock-market split between companies of different credit quality signals a rotation beneath the surface.

An equal-weighted index of US-listed stocks with the lowest leverage has outperformed a gauge tracking high-leverage counterparts by 6.6 percentage points in May, data compiled by Barclays Plc show. Since the pandemic rocked markets in early 2020, the gap has only been wider in June 2022, when stocks took a drubbing as the Fed’s jumbo rate increases kicked in.

Few investors, if any, expect the US to default. Bloomberg Intelligence sees a less than 1% probability that America will delay its payments.

Read More: Yellen’s X-Date Risk Is Real If No Deal, Debt-Limit Model Shows

But the risk is that stocks crater broadly if lawmakers fail to enact an agreement in time. Should that happen, DataTrek Research Inc. strategists recommend watching some key levels in the S&P 500 to see if it finds support on the way down. One is 3,840, where it started the year, and the other is 3,783, which it hit on Dec. 28 when the Nasdaq 100 posted its lowest close since 2020.

The S&P 500 rose 0.3% to 4,205 this week, while the Cboe VIX Index — the market’s so-called fear gauge — closed at 17.95 after rising above 20 on Wednesday for the first time in three weeks.

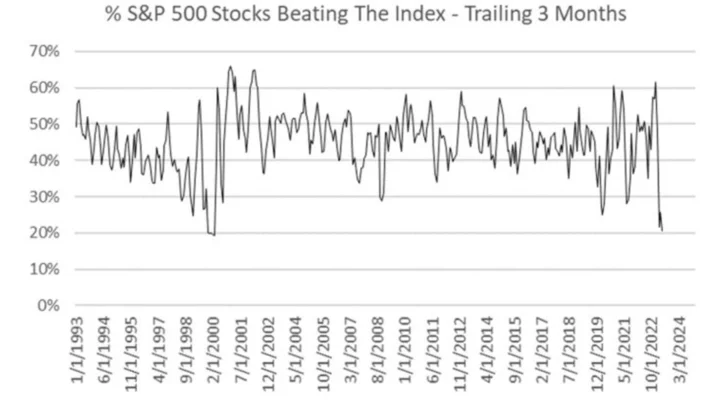

This year’s rally in the S&P 500 has been driven almost exclusively by Big Tech, and that narrow participation makes it particularly sensitive to a rapid selloff should the debt-ceiling negotiations flounder. Only about 20% of the gauge’s members have outperformed the overall benchmark on a three-month trailing basis as of Thursday, the smallest proportion since 2000, data compiled by Piper Sandler show.

“The market is extended and is due to pullback irrespective of any debt-ceiling headline,” said Adam Sarhan, founder of 50 Park Investments. “Big Tech is doing its best to lift indexes, but if there’s not more participation in other industries, another leg lower could easily be triggered.”

To Morgan Stanley Investment Management’s Andrew Slimmon, however, a debt-limit resolution eventually opens the door for stocks to rally in the latter part of 2023. The S&P 500 could rise toward 4,600 into year-end as markets price in an earnings recovery in 2024 and more investors get drawn in, he said.

Over at Bank of America Corp., some clients are refraining from putting money into the stock market until the impasse is over.

“I can’t even count at this point the number of investors that we’ve spoken to who have capital to deploy but are waiting until we get past that calendar date,” Savita Subramanian, head of US equity and quantitative strategy at the firm, told Bloomberg Radio.

“The prevailing assumption even amongst the bears is that even under a protracted deliberation and brinkmanship we get a resolution, so the market sells off and comes right back,” she said.

--With assistance from Madison Mills.

Author: Elena Popina, Jessica Menton and Alexandra Semenova