Asian equities may struggle to find traction Monday in a cautious open to trading around the region, while in currency markets the yen was on the front foot following potentially hawkish remarks for the Bank of Japan governor.

Futures for Australia were fractionally higher, a gauge of US-listed Chinese stocks fell and contracts for Japan showed a small gain in trading that ended before an interview by BOJ’s Kazuo Ueda reached the market. Hong Kong reopens after a closure Friday due to a heavy rainstorm.

The yen strengthened back below 147 versus the dollar after Ueda told the Yomiuri newspaper there may be sufficient information by year-end to judge if wages will continue to rise, which is a key factor in deciding whether or not to end super-easy policy. While this will fuel speculation that negative rates and yield-curve control are drawing near a close, the central bank chief also said the BOJ is some distance away from achieving its price stability target.

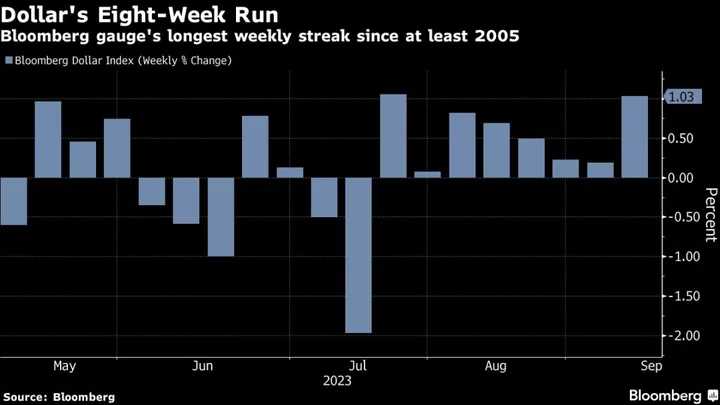

The dollar edged lower against other Group-of-10 counterparts after its recent rally drove the currency to a record streak of weekly gains. The greenback has been bolstered recently by bets the Federal Reserve will keep interest rates higher for longer as the US defies a global economic gloom.

The Bloomberg Dollar Spot Index notched its eighth straight up week — the longest such run since 2005. The advance sent its 14-day Relative Strength Index above 70 — which is seen by some on Wall Street as a sign of an overbought market.

Fed Bank of New York President John Williams said late Thursday US monetary policy is “in a good place,” but officials will need to parse through data to decide on how to proceed on interest rates. His Dallas counterpart Lorie Logan noted that skipping an interest-rate hike at the central bank’s upcoming policy meeting may be appropriate, while also signaling rates may have to rise further to get inflation back to 2%.

US stock futures were little changed early Monday after shares saw small moves at the end of the week, with the S&P 500 edging higher after a three-day drop. Nvidia Corp. and Tesla Inc. weighed on the megacap space, while Apple Inc. bounced after a rout that erased $190 billion in value just a few days before the unveiling of the iPhone 15, new smartwatches and the latest AirPods.

The rising threat of interest rates staying higher for longer is likely to dent prospects of a soft landing for the US economy and drive a selloff in stocks over the next two months, according to Bank of America Corp. strategists led by Michael Hartnett.

The consensus probability of a hard landing is “around 20%,” but oil, dollar and bond yields remaining elevated, as well as tighter financial conditions, “remain the September-October risk,” they said.

Key events this week

- UK jobless claims, unemployment, Tuesday

- Eurozone industrial production, Wednesday

- UK industrial production, Wednesday

- US CPI, Wednesday

- Eurozone ECB rate decision, Thursday

- Japan industrial production, Thursday

- US retail sales, PPI, business inventories, initial jobless claims, Thursday

- China property prices, retail sales, industrial production, Friday

- US industrial production, University of Michigan consumer sentiment, Empire Manufacturing index, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 7:25 a.m. Tokyo time. The S&P 500 rose 0.2%

- Nasdaq 100 futures rose 0.1%. The Nasdaq 100 rose 0.1%

- Nikkei 225 futures rose 0.3%

- Australia’s S&P/ASX 200 Index rose 0.1%

Currencies

- The euro was little changed at $1.0710

- The Japanese yen rose 0.4% to 147.22 per dollar

- The offshore yuan was little changed at 7.3614 per dollar

- The Australian dollar rose 0.2% to $0.6391

Cryptocurrencies

- Bitcoin rose 0.4% to $25,920.92

- Ether rose 0.3% to $1,623.3

Bonds

- The yield on 10-year Treasuries advanced two basis points to 4.26%

Commodities

- West Texas Intermediate crude fell 0.5% to $87.06 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.