This year’s US stock market rally is strong enough to withstand another leg higher for bond yields, according to the latest Markets Live Pulse survey.

With the soft-landing narrative for the world’s biggest economy gaining traction, the majority of 331 respondents expect losses for S&P 500 Index to be contained to less than 10% should yields on the 10-year Treasury resume their climb and hit 4.5%. That would allow the US equities benchmark to hold on to some of its 18% year-to-date gains.

“If we get higher interest rates and bond yields, it will probably be because the macro economy surprises on the upside,” said Christopher Hiorns, portfolio manager at EdenTree Investment Management Ltd. “So equities, providing protection against inflation, may not be such a bad place compared to bonds.”

Yields on the 10-year note reached a 16-year high of 4.36% in August as a persistently resilient US economy has investors betting interest rates will remain elevated. The jump in yields made August the worst month for the S&P 500 since February, though the stocks gauge remains at considerably higher levels than during prior periods when yields were as elevated as they are now.

With the Federal Reserve prepared to keep borrowing costs elevated until inflation is on a convincing path toward the US central bank’s 2% target, there’s more room for yields to rise even further. Federal Reserve Bank of Cleveland President Loretta Mester said on Friday inflation remains too high despite recent improvements.

However, strategists expect any march higher to be capped near 4.5%. Such a yield on the 10-year would drop the S&P 500 Index year-end target of HSBC Holdings Plc’s US equity strategy team to 4,500 from 4,600 — leaving the stock gauge with a 17% gain in 2023.

Some strategists see yields falling. Wouter Sturkenboom, chief investment strategist for EMEA & Asia Pacific at Northern Trust Asset Management, expects the yield on the 10-year note to trade around 4% by the end of the year.

And further stock gains may be a lot harder to come by, MLIV’s Ven Ram notes. In a world where you can lock in two-year US yields at a whisker short of 5%, you need to be immensely optimistic about underlying earnings growth to forgo the certainty of cash flows offered by Treasuries. It’s also hard to share the market’s optimism on the prospect of a soft landing.

Survey respondents also predict the yield on the 10-year Treasury inflation-protected securities will be lower five years from now, indicating that real interest rates, defined as nominal rates minus inflation, will come down.

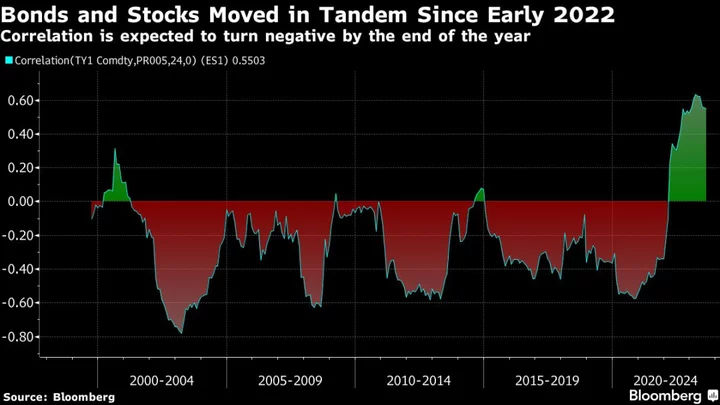

Meanwhile, the correlation between stocks and bonds has been positive since early 2022 as markets braced for the Fed’s tightening campaign to quell soaring inflation. Just over 50% of survey takers expect that relationship to turn negative by the end of this year, reverting to the long-term trend of this century.

At the same time, the poll showed 59% of investors still see a portfolio consisting of 60% stocks and 40% bonds as a viable investment strategy. Such portfolios were hammered last year as both asset classes fell in tandem, marking the strategy’s worst performance since 2008. It’s up 12% this year.

The sticking power of the US stock rally in 2023 has taken several market participants by surprise, but bulls point to solid economic growth in the face of high interest rates as a sign of confidence. Outperforming tech names, bolstered by the frenzy for anything artificial intelligence-related, have helped sustain those gains.

That said, most MLIV survey respondents see real estate and technology as most at risk from a 4.5% Treasury yield, while more than half said banks will be the biggest winners. A downturn for technology stocks would be significant with the Nasdaq 100 Index soaring 42% so far in 2023.

“We should be concerned about loss-making parts of the tech sector but I expect that the profitable tech companies, which are large and very significant earnings contributors to indexes, should be somewhat immune to higher yields,” said Rajeev De Mello, a global macro portfolio manager at Gama Asset Management SA.

The growing concern about stocks with lofty valuations, like those in the tech sector, is also reflected by the more than 50% of MLIV survey participants expecting value stocks to catch up, or even outperform, their growth counterparts by the end of the year. So far, the S&P 500 Growth Index — which includes Apple Inc. and Nvidia Corp. — is outperforming the S&P 500 Value Index by the most since 2020. European investors were more positive about growth stocks the rest of the year than their US and Canadian peers.

“We’re of the view that yields are peaking, dips in equities will be bought by managers that have underperformed and have to play catch-up into year end, and earnings estimates continue to be revised up modestly,” said Thomas Hayes, chairman of Great Hill Capital. “A Goldilocks environment.”

The MLIV Pulse survey of Bloomberg News readers on the terminal and online is conducted weekly by Bloomberg’s Markets Live team, which also runs the MLIV blog. This week, the survey focuses on American consumers. Are they flush with cash or about to go broke? Share your views here.

--With assistance from Sagarika Jaisinghani.

(Adds regional breakdown in 15th paragraph)