A strong earnings season for technology companies is going largely unrewarded in a stock market that has already priced in a rosy outlook.

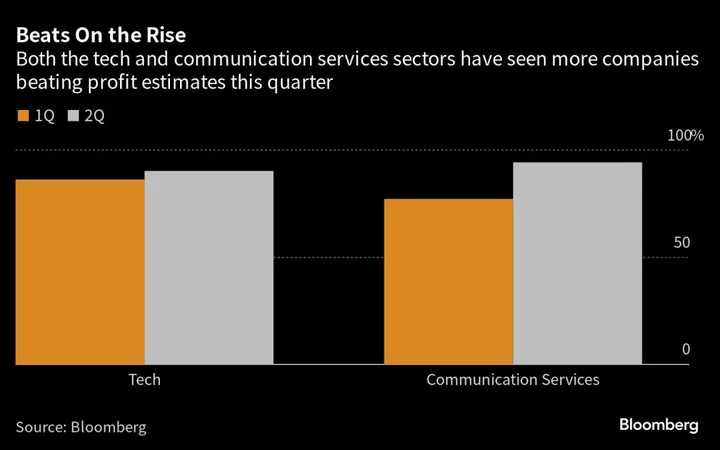

With the majority of S&P 500 Index members having reported, technology and internet firms have been standouts with some of the highest earnings beat rates among major groups. About 89% of technology companies that have reported so far have exceeded estimates, yet the stocks have fallen an average of 0.8% the day after, according to data compiled by Bloomberg.

The sputtering rally is no surprise to Gregory Halter, director of research at Carnegie Investment Counsel, given this year’s stock gains have lifted valuations toward levels last seen when interest rates were near zero.

“You need to have results that are just incredible, incredible, incredible for that to be sustained,” he said in an interview. “It makes sense that we are seeing a pause and a pullback this season.”

Communication services stocks have fared even worse, falling an average of 2.4%, even as 16 of 17 companies exceeded profit estimates.

Apple Inc. shares fell as much as 4.1% on Friday despite the iPhone maker beating revenue estimates, amid worries over demand for its handsets and other gadgets. Still, traders were more impressed by better-than-expected sales and profitability for Amazon.com Inc., sending the stock up as much as 10%.

The Nasdaq 100 has gained more than 40% this year, pushing valuations well above the 10-year average at about 25 times projected profits. However, the index is down 3.2% from a July 18 peak when earnings season was just getting underway.

Apple Set to Relinquish Historic $3 Trillion Value as Sales Fall

“A lot of these beats were priced in and as a result there’s not a lot of excitement,” said Michael Casper, an equity strategist with Bloomberg Intelligence.

The bond market has become another obstacle to the stock rally. The 10-year US Treasury yield hit a nine-month high on Wednesday amid robust economic data and focus on the US’s expanding fiscal deficits, after Fitch Ratings stripped the nation of its AAA credit rating. Tech stocks are more sensitive to interest rates, which are used to determine the present value of profits expected further in the future than other sectors.

Many analysts have already begun to raise estimates for the second half of the year. Profits for the tech sector in 2023 are now projected to fall 7.9% compared with an 8.2% drop expected a month ago, before earnings season got underway, according to data compiled by BI.

A pause in the rally could set the stage for more gains in the near future as estimates continue to climb, making valuations more attractive, says Bloomberg Intelligence’s Casper.

“If tech multiples were able to moderate a bit it could go a long way to helping investor sentiment in the group, given how skittish everybody is about valuations right now,” he said.

Tech Chart of the Day

The 10-year Treasury yield is at the highest level since November 2020 and in territory that has caused pain for technology stocks in the past.

Top Tech Stories

- Amazon.com Inc. Chief Executive Officer Andy Jassy pulled off a financial double play this earnings season: generating strong revenue growth in the core e-commerce business while cutting the pace of spending.

- Apple Inc. posted its third straight quarter of declining sales and predicted a similar performance in the current period, hurt by an industrywide slump that has sapped demand for phones, computers and tablets.

- Alphabet Inc. illegally ended contract employment for a majority of Google Help workers as they were trying to unionize, organizers alleged in a complaint to the US labor board.

- Apple Inc., Samsung Electronics Co. and HP Inc. are among the biggest names freezing new imports of laptops and tablets to India after the South Asian country abruptly banned inbound shipments without a license.

- WPP Plc shares dropped on Friday as the UK-based advertising group cut its revenue guidance for the full year, citing lower sales in the US from tech clients. “It took us a little bit by surprise,” Chief Executive Officer Mark Read said in an interview.

- Aakash Educational Services Ltd., the tutoring business unit of edtech firm Byju’s, is reconstituting its board under an agreement with creditor Davidson Kempner Capital Management LP after certain loan covenants were breached, according to people familiar with the matter.

- As investor interest in artificial intelligence sends shares of technology giants soaring, a little-known circuit board maker in South Korea is cashing in big.

Earnings Due Friday

- Premarket

- Liberty Formula One

- Liberty Broadband

- Liberty SiriusXM

- Cinemark

- U.S. Cellular

- Gray Television

- EW Scripps

- AMC Networks

- Nikola

--With assistance from Ryan Vlastelica and Kit Rees.

(Updates shares throughout.)