South Korea’s trade minister said his country is prepared to look for alternative sources of graphite if China’s newly-strengthened export controls on the key material used in electric-vehicle batteries lead to a severe shortage.

“We will try to find the alternative source and we will basically do as we prepared so far,” Trade Minister Ahn Duk-geun said Friday in an interview, invoking South Korea’s previous experience of dealing with supply-chain disruptions stemming from Japan’s export controls on chipmaking materials in 2019.

Earlier in the day, Beijing strengthened export controls on some categories of graphite, calling it a measure needed to “safeguard national security and interests.” Graphite deemed highly sensitive will be subject to so-called “dual-use item” export controls from Dec. 1. The announcement came days after the US bolstered efforts to keep advanced chips out of China.

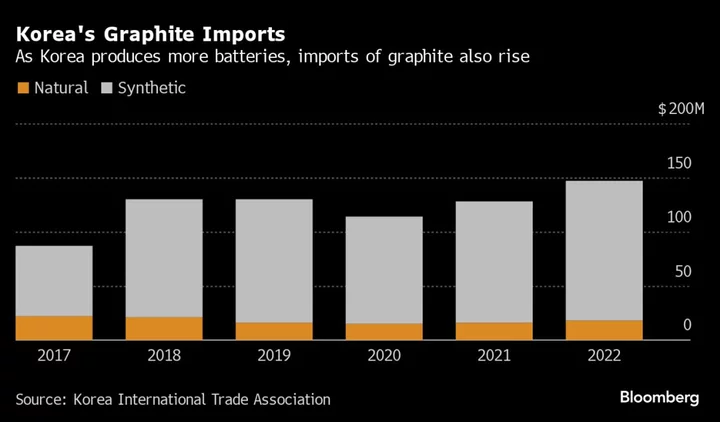

Graphite is essential in producing EV battery anodes, a terminal inside a rechargeable cell. China accounts for about 60% of natural production capacity and 90% of the synthetic variety that typically lasts longer, charges faster and improves safety. China said its measures don’t target any specific country.

Ahn said South Korea will monitor the severity of the developing situation, and the impact could be smaller than feared. He cited China’s decision in August to restrict exports of gallium and germanium — two metals crucial for parts of the semiconductor, telecommunications and electric-vehicle industries — before exports resumed the following month.

“At the time, those measures were mainly targeted against the United States,” he said. “So we need to see how much our industry might be impacted, and then we will see what we can do.”

Ahn also pointed to an agreement earlier this year in the US-led Indo-Pacific Economic Framework for Prosperity on supply chain coordination, saying it could help mitigate potential shortages of graphite.

“One difference is the 14 IPEF countries now established the supply chain agreement and the mechanism to protect us,” he said. “As soon as we have a problem, within two weeks we need to share the information and we will coordinate our response mechanism.”

“So these kinds of things will help a lot to deal with this situation.”

South Korea relies heavily on imports of materials and energy to assemble its exports. Ahn said it should ride out the latest challenge thanks to its lessons from previous experiences.

“We used to have some turbulent periods between Japan and Korea, when they initiated the export control measure related to semiconductor-producing ingredients,” Ahn said. “So we have some experience and we are implementing those measures — supply chain management mechanisms.”

The dispute between Japan and South Korea came to an end after their leaders held a summit in Tokyo earlier this year and pledged greater technology cooperation.

--With assistance from Heejin Kim.