South Africa will sell its second Islamic bond Wednesday as the government accelerates its efforts to plug a borrowing shortfall of $2.6 billion for this fiscal year.

The country’s last sukuk was a dollar-denominated bond sold in 2014, with today’s auction the first to be held in local currency. The national Treasury will target an amount of 20 billion rand ($1.1 billion), with the option to increase that figure if there is appetite.

Africa’s most industrialized economy has been locked out of international debt markets since April 2022, due to high global interest rates that make the cost of foreign debt prohibitive. The dollar sukuk, which matured in 2020, attracted non-resident investors, but that looks unlikely this time round, said Farzana Bayat, a fixed income portfolio manager at Foord Asset Management in Cape Town.

“Given the large size, we had initially thought there would be a large offshore anchor buyer, but that doesn’t seem to be the case — it looks like appetite is mainly local banks,” said Bayat. “We are also not sure if the offshore market has appetite for a rand sukuk. If foreigners buy a rand sukuk and hedge out the currency risk, the net dollar yield wont be very appealing.”

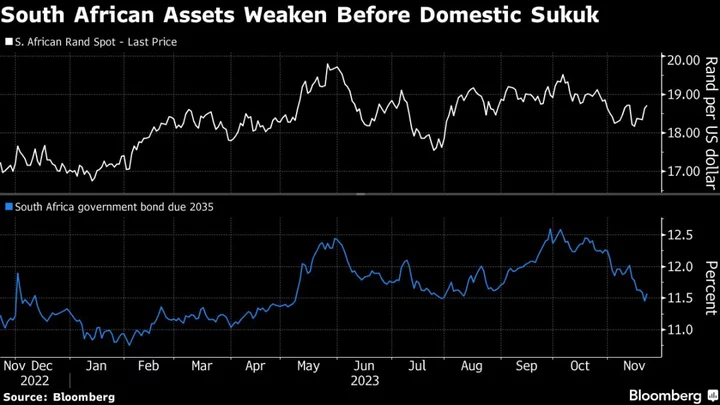

Both the rand and South African government bonds were weaker before the sale. The yield on 10-year notes rose 12 basis points to 11.57%. The rand fell 0.5% to trade at 18.7399 per dollar as of 11:33 a.m. in Johannesburg.

Pricing guidance for the 5.3 year tenor was 9.6%, for the 7.3 year 10.45%, for the 10.3 year 11.25% and for the 12.3 year 11.65%, according to a term sheet seen by Bloomberg.