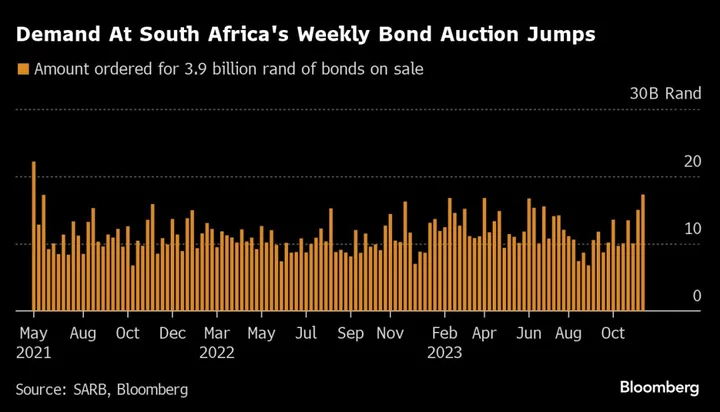

South African attracted nearly $1 billion of orders at Tuesday’s weekly auction of government debt, the strongest demand in more than two years, as investors lock in yields seen falling into year-end as inflation slows and fiscal challenges ease.

Primary dealers placed orders for 17.3 billion rand ($924 million) of securities at Tuesday’s sale, more than four times the 3.9 billion rand on offer and the most since May 2021.

Yields on government securities reached post-pandemic highs in September, making them the worst performers in emerging markets at the time after Turkey, amid a relentless selloff fueled by concerns about a burgeoning budget deficit. That left them attractively valued and ripe for a rebound, which gained impetus after the government reassured investors it won’t increase supply at the weekly auctions.

“There is no doubt that the market had priced in too much premium in local assets,” said Deutsche Bank AG strategists including Christian Wietoska in a note to clients. South Africa’s 10-year yield still trades at a premium of more than 60 basis points over similarly-rated Brazil.

In the near term, attractive returns, record light positioning, favorable supply dynamics and cheap valuations pointed to a rally to close 2023, according to the Deutsche Bank strategists.

“We expect strong price action into the year-end and remain ‘overweight’ in our portfolio,” they wrote.

South African Bonds Turn Into EM Winners, With More to Come

The yield on benchmark 2035 securities fell seven basis points to 11.94% by 2:23 p.m. in Johannesburg, leading gains for emerging-market bonds monitored by Bloomberg. The yield has dropped 65 basis points from a Sept. 28 high of 12.59%.