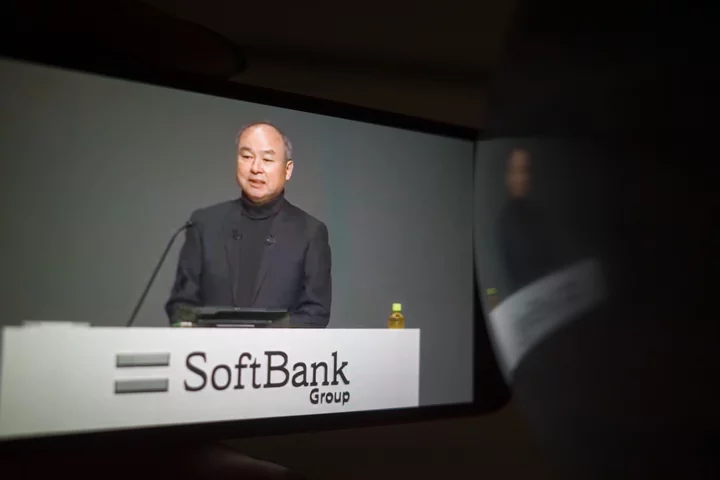

Masayoshi Son is due to make his first public appearance in seven months at SoftBank Group Corp.’s annual shareholder meeting on Wednesday, with cash-strapped startups wondering if the world’s biggest tech investor will ever go on the offensive again.

The debt-laden Tokyo-based conglomerate is hosting the meeting in person for the first time in four years. Son is scheduled to break a months-long silence after the billionaire bid adieu to earnings calls amid mounting losses to focus on taking Arm Ltd. public.

Prospects for the chip design unit’s initial public offering have brightened recently, buoyed by hype around generative AI and talks with potential anchor investors including Intel Corp. Arm is seeking to raise as much as $10 billion, Bloomberg News reported, and brokerages are revising up their SoftBank stock price targets. The company’s shares have gained about 25% so far in the June quarter, heading for their best quarterly performance in three years.

But the outlook for SoftBank’s flagship Vision Fund investment unit remains bleak. Slumping tech valuations have forced it to shoulder billions of dollars in losses for five straight quarters. Investments at SoftBank’s funds have ground to a virtual halt, forcing belt-tightening throughout the startup ecosystem.

SoftBank invested in seven startups through funding rounds totaling about $550 million so far in the June quarter, data compiled by Bloomberg show. For reference, the Vision Fund segment spent $15.6 billion in the same quarter just two years ago.

“Although the downside caused by geopolitical risks and other factors continues to be unpredictable, innovative information technologies keep evolving rapidly,” Son wrote in a letter to shareholders dated May 29. Son’s comment echoed previous remarks by Chief Financial Officer Yoshimitsu Goto about the possibility of SoftBank shifting gears away from total defense.

“While maintaining financial soundness, we will make investments that drive the information revolution, and strike a balance of ‘defense’ and ‘offense’,” Son said.

Here is what investors and analysts are saying:

Astris Advisory (Kirk Boodry)

- It’s hard to say whether the message on defense-mode will change significantly, but “even if Son is delivering the same message, he’s going to sound much more optimistic and focused on the technology as opposed to the balance sheet, like Goto would.”

- Sentiment plays a part in Arm. “They have to balance two things — they want to maximize the money they raise in selling equity because that goes right to SoftBank, in the heart of its valuation. But they also don’t want a situation they’ve had with a lot of their IPOs where it goes public and then everything goes down in value.”

- “The real wild card here is how public markets perform and that’s the thing that no one has any control over, and unfortunately still has a lot to do with the timing and valuation of Arm.”

Asymmetric Advisors (Amir Anvarzadeh)

- Son’s reported meeting with OpenAI’s Sam Altman sets the stage for the founder and billionaire to make “a grand comeback” with big names to drop at the shareholder meeting.

- Son is likely to claim SoftBank is Japan’s purest AI play for its size. “Those who know Son are very familiar with this script and yet another timely rescue by a thematic market.”

Comgest Asset Management (Richard Kaye)

- “Son could explain his long view of the Vision Fund –- a Darwinian instrument to select the strongest future technology companies with a view to consolidating those, or a regular fund looking to buy and exit?”

- SoftBank’s Japan businesses Z Holdings Corp. and SoftBank Corp. should be important sources of growth, bringing together the group’s bright spots like messaging service LINE and digital payments platform PayPay. “But I think some investors have been disappointed waiting for this story to work. If Son can give some comfort on that area, it would help.”

- “It would be very helpful to understand better Son’s own role, where he spends time and whether he will return to addressing investors. Yes, I would to like see him back.”

--With assistance from Edwin Chan and Kurt Schussler.