Major Wall Street bank analysts will begin weighing in on one of the most-watched initial public offerings in the US so far this year.

Arm Holdings Plc raised $4.87 billion last month in the largest IPO on a US exchange since Rivian Automotive’s $13.7 billion offering in November 2021. Starting next week, analysts at the more than 25 firms, including Barclays Plc, Goldman Sachs Group Inc., JPMorgan Chase & Co. and Mizuho Financial Group Inc., that participated in the IPO can initiate coverage of the chip designer.

So far, analysts who aren’t beholden to the so-called quiet period are generally cautious on Arm.

“We think the company’s strong control over the smartphone ecosystem and consequent pricing power can support growth, but it will face challenges when trying to replicate its success in other technology sectors,” Needham analyst Charles Shi, who has a hold rating on the firm, wrote in a note dated Sept. 26. “Given our assessment of fundamentals, we think the IPO price represents a full valuation and foresee little upside from here.”

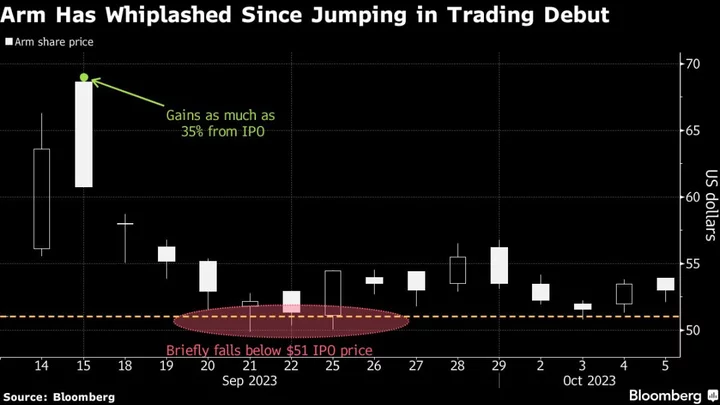

Since its IPO priced at $51 on Sept. 13, shares have gained about 2%. Shares were down nearly 1% Friday at 9:40 a.m. New York time.

Arm, still majority owned by SoftBank Group Corp., has one buy rating, three holds and one sell with an average price target of about $53, according to data compiled by Bloomberg.

Investors may be overvaluing Arm and overestimating how much profit growth it can achieve, according to David Trainer, CEO of New Constructs, who rates the stock unattractive.

“It was a very overpriced IPO, so I think this is probably long-term going to end up a lot lower,” said Trainer.

Pierre Ferragu of New Street Research has the sole buy-equivalent rating on Arm. On Thursday, Ferragu raised his price target on the company to a Street-high of $66 from $59, after boosting his estimate for the company’s 2025 royalty revenue by 20%.

Arm’s IPO alongside the debuts of online grocery-delivery firm Instacart Inc. and data automation platform Klaviyo is seen as a gauge of investor appetites for newly-public companies.

While all three gained on their first day of trading, Arm and Instacart have struggled to hold onto those early jumps in price. Arm is trading just above its IPO price and has fallen below that level on an intraday basis. Instacart slipped below its IPO price on Sept. 26 and has fallen further since. The price action potentially signals that investors have become more cautious.

(Updates stock moves at market open.)