SoftBank Group Corp.’s Vision Fund eked out its first profit in more than a year, thanks to a global tech rebound that helped lift the value of some of its investments.

The Vision Fund unit swung to a profit of ¥61 billion ($426 million) in the quarter ended June, compared with a ¥2.33 trillion loss for the same period a year ago. That helped SoftBank report a smaller group-wide net loss of ¥477.6 billion versus a ¥3.16 trillion loss last year, with earnings dragged down by paper losses on its stakes in Alibaba Group Holding Ltd., Deutsche Telekom AG and T-Mobile US Inc.

That’s a reprieve for the Vision Fund unit, which lost a record $30 billion last fiscal year. SoftBank invested billions of dollars in unprofitable startups from 2017, inflating valuations worldwide before they were punctured by China’s tech crackdown starting 2020 and the US Federal Reserve’s rate hikes last year.

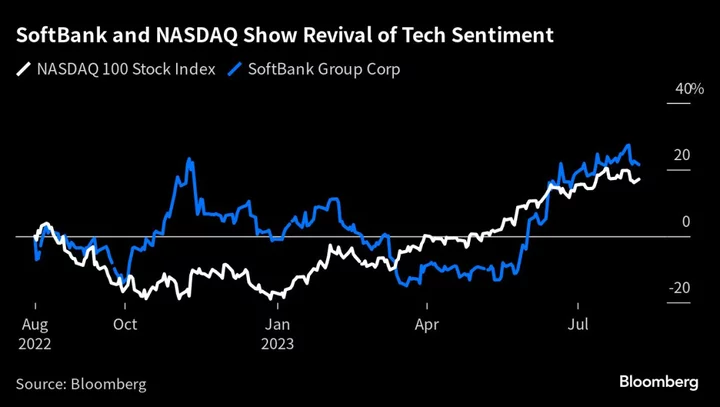

The Nasdaq 100 index, a proxy for tech stock performance, rallied 15% during the June quarter, capping its best ever first-half of a year. Hype over artificial intelligence and easing concern over higher interest rates have bolstered SoftBank’s investments in companies including Grab Holdings Ltd., Coupang Inc. and Roivant Sciences Ltd.

“I think you can anticipate the trend to continue,” said Tomoaki Kawasaki, a senior analyst at Iwai Cosmo Securities Co. SoftBank founder Masayoshi Son’s recent comments that the Vision Fund will soon resume startup investments are adding to such hopes, he said.

The Vision Fund unit invested $1.6 billion in the quarter, a fraction of Son’s spending during the division’s early years. Whether the CEO will be able to go on the offensive and hunt for new deals hinges on the initial public offering of SoftBank’s Arm Ltd.

Arm, however, logged a quarterly loss of ¥9.5 billion on a 11% decline in sales in dollar terms on a slowdown in semiconductor industry sales, SoftBank said.

The chip designer seeks to raise as much as $10 billion in a market debut as soon as September at a valuation of between $60 billion and $70 billion. If successful, that would make Arm the largest tech debut on record after Alibaba Group Holding Ltd. and Meta Platforms Inc.

“Once Arm goes public, investors would be able to bet on two profit streams: one from Arm and other AI- and chip-related investments; and another from the expansion of Vision Fund investments,” Iwai Cosmo’s Kawasaki said. How US equities and the Nasdaq index perform will be key, he said.

--With assistance from Vlad Savov.

(Adds details from earnings statement from second paragraph)