Economists expect the Swiss National Bank to raise interest rates for a final time in September, even as inflation is seen slowing faster than the central bank has estimated.

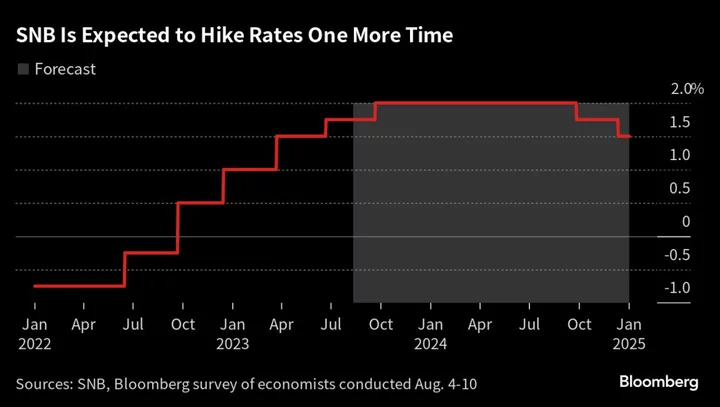

The SNB will hike by 25 basis points to 2% at its next scheduled decision on Sep. 21, according to a Bloomberg survey conducted from Aug. 4 to 10. Rates will remain at that level for a year, with a first cut forecast in September 2024 and another three months after that.

Economists are significantly more upbeat on inflation than the central bank. In its most recent estimates — from June — the SNB said consumer-price growth would rebound from recent lows, peaking at 2.3% in the third quarter of next year.

In contrast, the economists see the inflation rate staying below the SNB’s 2% ceiling through the end of 2024. in that quarter. On an annual basis, the central bank predicts inflation to average at 2.2% in 2024, while the median survey estimate sees it at 1.5%.

While economists still expect a September hike, the survey could add to doubts on the SNB’s hawkishness going forward. Central bank President Thomas Jordan said in June that “most likely there could be more rate hikes necessary in order to bring inflation on a permanent basis below 2%,” given a wave of rent increases is expected in the second half of this year and electricity prices are set to rise in January.

But the recent surge of the franc, which shields Switzerland from imported price pressures, and signs for a slowdown of economic activity might have changed officials’ minds. The SNB will present its next inflation forecast with its rate decision in September.