The Swiss National Bank delivered the smallest interest-rate hike since it began monetary tightening a year ago while signaling it may act again to tame inflation.

Policymakers led by President Thomas Jordan lifted the key rate by a quarter-point to 1.75%, matching forecasts by most economists surveyed by Bloomberg.

The step is aimed at “countering inflationary pressure, which has increased again,” officials said in a statement. “It cannot be ruled out that additional rises in the SNB policy rate will be necessary to ensure price stability over the medium term.”

The decision to dial down hiking suggests Swiss officials are becoming less concerned about the threat posed to consumer prices as the country experiences the slowest inflation of any advanced economy.

The central bank, which unveils rate announcements only once a quarter, is acting to tame such pressures both domestically and globally as it plays catchup to more advanced tightening elsewhere. The SNB has now raised borrowing costs by 250 basis points since starting out last year, compared with 400 basis points in the euro zone and even more in the US.

The Swiss decision coincides with another round of hikes in the region on Thursday, with increases of at least a quarter-point, and possibly more, widely anticipated in Norway and the UK.

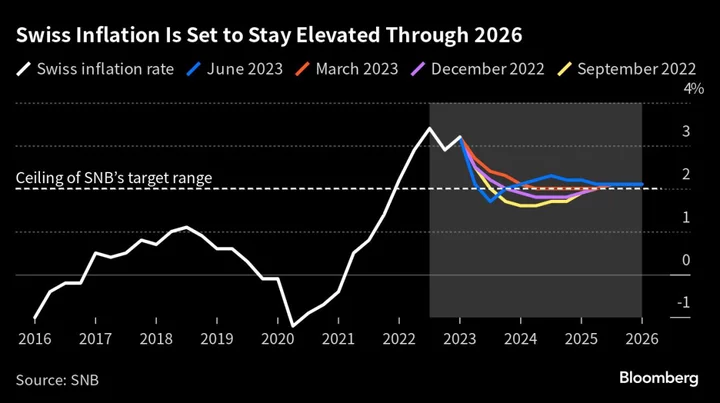

The SNB’s move to slow tightening jars with Jordan’s hawkish language of late and suggests recent data — including three months of slowing price growth and a drop in an underlying measure to below the 2% ceiling targeted by officials — have begun to provide reassurance that the country is exiting the danger zone.

The central bank projects inflation of 2.2% in 2023, 2.2% in 2024 and 2.1% in 2025. That compares with prior forecasts for 2.6% this year and 2% in the following two.

After an unexpectedly strong recovery at the start of the year, the SNB expects the Swiss economy to grow about 1% this year — down from 2.1% in 2022.

Jordan, who’ll hold a press conference in Zurich, will also face questions about the SNB’s financial-stability report for the year, which was released earlier Thursday and for the first time included the consequences of Credit Suisse Group AG’s near-demise and its subsequent government-brokered takeover by UBS Group AG.

--With assistance from Joel Rinneby, Paula Doenecke, Claudia Maedler, Fergal O'Brien, James Regan and William Horobin.