Singapore Inc. has some ways to go when it comes to climate-related disclosures, as mandatory reporting rules are set to kick in.

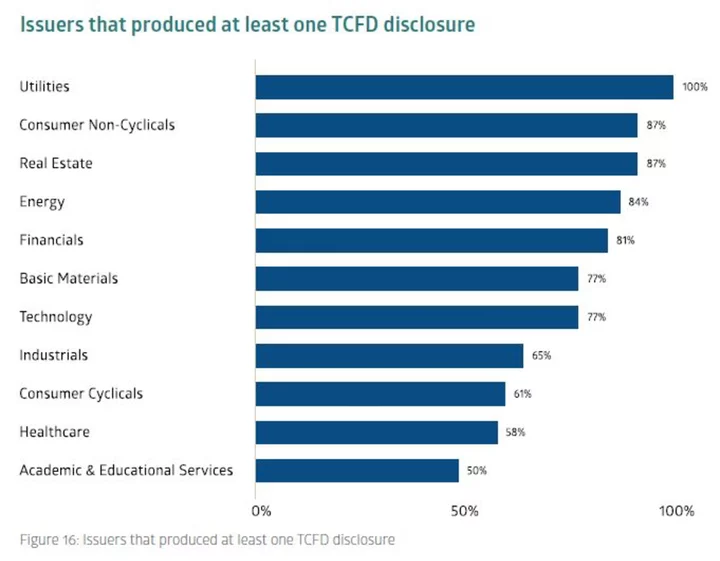

Only 43% of Singapore-listed companies made disclosures in line with at least five of the recommendations of the Task Force on Climate-related Financial Disclosures in their 2022 fiscal year sustainability reports. This is according to a biennial study by Singapore Exchange Ltd.’s regulatory arm and the Centre for Governance and Sustainability at the NUS Business School. That’s lower than the global average of 58%, based on the latest TCFD data.

Singapore began phasing in climate-related reporting about a year ago in an effort to meet global standards and promote green finance. While the broader reporting of ESG metrics is improving, authorities have their work cut out to coax boards and management into identifying climate-related risks, especially for the many small- and mid-sized enterprises in the country.

“The specific focus on climate change perhaps has not been manifested into the boardroom” and companies need to go beyond stipulating targets, Lawrence Loh, director at the Centre for Governance and Sustainability, said at a briefing. “Most companies are still finding their feet in climate-related disclosures.”

The findings come as Singapore Exchange Regulation has mandated climate reporting for certain sectors such as financials, agriculture and energy from the 2023 fiscal year, expanding the rules to transportation and materials from 2024.

To be sure, overall sustainability reporting has improved for Singapore-based firms since 2019, according to the study, which covered 535 companies. Most businesses have also set targets related to carbon emissions or water and energy usage, while almost 90% disclosed at least one of their Scope 1, 2 or 3 emissions.

Still, many firms — particularly smaller ones — are left wanting in the areas of scenario analysis for various climate conditions, identifying climate risks for the future and integrating climate change into their overall risk management. A lack of resources and awareness about how to carry out such practices rank among reasons as climate reporting is still in its early stages, Loh said.

Climate change is a particularly pertinent issue for the island nation. In 2019, Prime Minister Lee Hsien Loong said Singapore would need to spend S$100 billion ($75 billion) over the next 100 years to protect against rising sea levels, while its central bank is pumping billions of dollars into a climate transition program.

“No one, certainly not us, should be surprised with the findings given the pace at which these requirements were introduced,” said Tan Boon Gin, chief executive officer at SGX RegCo, at the same briefing. “But we cannot slow down because we just do not have the luxury of time.”

--With assistance from Sheryl Tian Tong Lee.