Rene Benko’s €23 billion ($25 billion) retail and property empire is on the cusp of a wave of insolvencies as doubts grow that last-ditch efforts to secure emergency funding will succeed.

The Austrian mogul’s Signa, which consists of numerous units in various countries, may file dozens of insolvencies in the next weeks barring a late breakthrough, according to people familiar with the discussions.

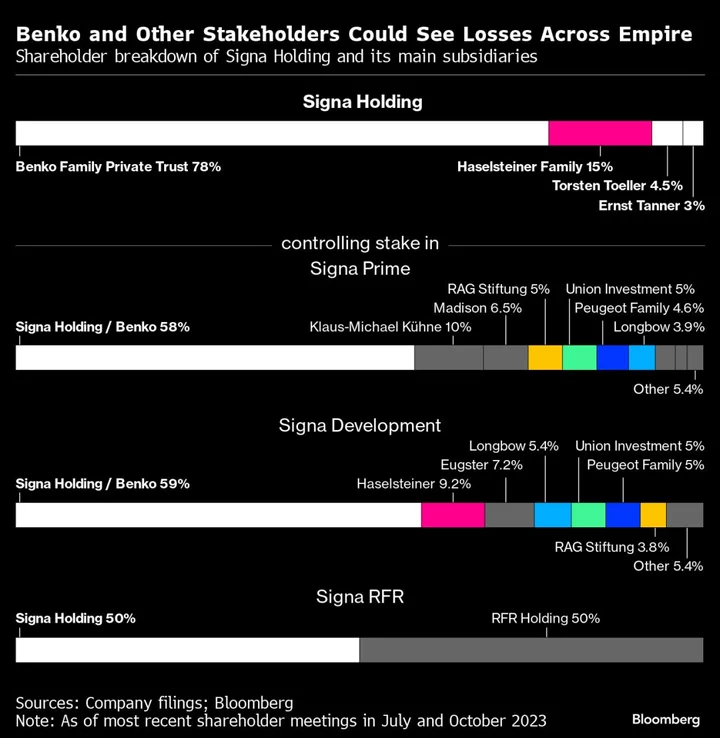

The closely-held group — which owns stakes in high-profile properties including New York’s Chrysler building, luxury malls in Vienna and Germany’s largest department-store chain — is racing to raise as much as €600 million to meet near-term liquidity needs. As the clock ticks down on finding a solution, talks are further hampered by Signa’s complex structure, which includes different investors and creditors at various levels, the people said, asking not to be identified citing internal matters.

In a sign of the cash crunch, Signa Real Estate Management Germany GmbH filed for insolvency in Germany, according to the country’s registry. A court in Berlin appointed Torsten Martini as provisional administrator of the company, which is a fully-owned subsidiary of Signa Prime, the co-owner of Selfridges in London and Berlin’s KaDeWe department store.

A spokesperson for Signa didn’t respond to a call and e-mail seeking comment.

Signa is at risk of becoming one of Europe’s largest property meltdowns since the global financial crisis. Commercial real estate has been hard hit by rising interest rates, ending more than a decade of rising valuations.

What sets Benko apart from many other property investors is that he continued to make high-profile acquisitions even in recent years. As valuations started to fall, investor distrust grew, and Signa’s obscure corporate structure left it especially vulnerable.

At the height of his empire building, Benko’s deal-making savvy lured high-profile investors from Europe’s elite, including Austrian construction tycoon Hans Peter Haselsteiner, German transportation magnate Klaus-Michael Kuehne and France’s Peugeot family. Benko’s family trust holds a majority stake across the group.

Benko, who boasted about having a portfolio that rivaled the British royal family and the Catholic church, started his career converting attic spaces in Innsbruck as a teenager. Last year, shareholders contributed almost €1 billion in fresh capital across the two largest units, Signa Prime and Signa Development.

But that generosity is under threat as the problems mount. With once-loyal shareholders — who stand to lose the most in the case of an insolvency — reluctant to chip in, other investors have stayed on the sidelines.

Mubadala Investment Co., Saudi Arabia’s Public Investment Fund, Attestor Capital and Elliott Investment Management were among funds approached for financing in recent weeks, according to the people.

Holders of a €300 million bond issued by Signa Development — the conglomerate’s only publicly traded security — include London hedge fund Arini. Saudi Arabia’s PIF has a junior debt position distributed throughout the Signa companies.

Signa’s largest exposure is toward banks via credit received to fund acquisitions and construction work on development projects, such as Hamburg’s Elbtower. Those loans are often secured against property, meaning banks may be able to recoup losses.

Julius Baer Group Ltd., one of the largest lenders to Signa, said Monday it was reviewing its business of offering loans to some of its wealthiest clients after running up 606 million Swiss francs ($687 million) in loans to a single counterparty.

While the bank didn’t name the client — whose loans are now being restructured — Bloomberg reported earlier that it’s Benko’s Signa and that Swiss regulator Finma was monitoring the exposure.

The lender “has taken measures to protect its interest and to preserve the value of its collateral,” Baer said Monday.

--With assistance from Karin Matussek, Giulia Morpurgo, Myriam Balezou and Luca Casiraghi.

(Updates with confirmation of unit’s insolvency filing in fourth paragraph.)

Author: Marton Eder, Libby Cherry and Laura Malsch