India’s shorter bonds rallied and money market rates eased on bets that a withdrawal of the nation’s highest value currency note would leave banks with surplus cash to invest.

As much as 1 trillion rupees ($12.1 billion) may be added to India’s financial system as authorities remove 2,000 rupee notes from circulation, according to QuantEco Research and Kotak Mahindra Bank Ltd. Consumers have until end-September to deposit the notes into their bank accounts or exchange them for other denominations.

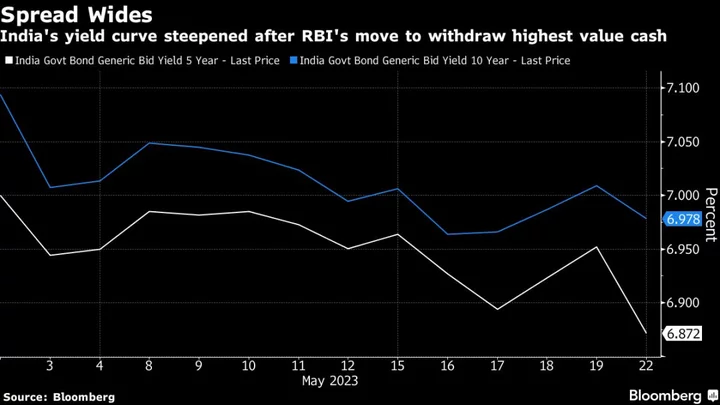

The five-year bond yield dropped as much as 10 basis points to 6.86% while the 10-year yield was down three basis points to 6.98%, resulting in a steeper curve. Yields on shorter commercial paper declined between five and 10 basis points while rates on treasury bills also retreated in secondary trading, traders said.

“We will see the short-end continue to rally as about 1 trillion to 1.5 trillion rupees of liquidity come into the banking system,” said Rajeev Pawar, head of treasury at Ujjivan Small Finance Bank. “The five-year will probably come down to 6.78%-6.75%.”

The liquidity injection may revive a rally in rupee government bonds, which lost momentum last week after the central bank’s dividend payout to the government fell short of traders’ expectations. A bigger payment would have enabled the Finance Ministry to cut its bond sales and lower borrowing costs.

Benchmark 10-year sovereign yields plummeted to 6.94% last week, the lowest in over a year on bets that India’s tightening cycle may be over. The yield slid 55 basis points in November 2016 following a move by authorities to withdraw almost all cash from circulation.

The weighted average call rate, which the Reserve Bank of India closely monitors, has held above the policy rate for most of the past month and even breached the emergency funding rate of 6.75% on some days.

“The move to withdraw the note will likely result in a temporary spurt in system liquidity owing to a higher deposit base,” Madhavi Arora, lead economist at Emkay Global Financial Services, wrote in a note. “We expect the bond curve to steepen in the near term, while forward premium will decrease further, putting pressure on the rupee.”

However, QuantEco expects the boost to the bond market to be short-lived. Banks’ holdings of fixed-income assets already exceed regulatory requirements and market expectations of the RBI injecting liquidity via open market purchases in the fiscal second half will fade, it said in a note.

--With assistance from Divya Patil.

(Updates with market moves in third paragraph and Ujjivan comment in fourth paragraph)