Bets against regional banks continue to pile on even as the sector recovers from the turmoil that shook financial markets in March.

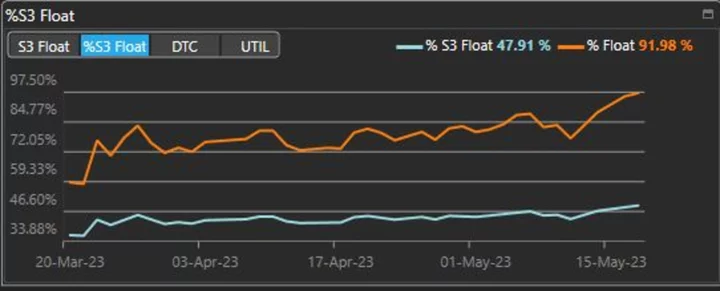

Short interest as a percentage of shares outstanding in the SPDR S&P Regional Banking ETF (ticker KRE) rose to 92% from 74% a week ago, according to data compiled by S3 Partners, a technology and data-analytics firm. When accounting for the synthetic long bets created in each short sale, it means almost 48% of positions in the ETF are wagering on a decline, up from 42% last Wednesday.

Meanwhile, the short interest as a percentage of tradeable float for the $28.6 billion Financial Select Sector SPDR Fund (XLF) has increased by over 50% since March, when a series of banks collapsed.

To be sure, the heightened short interest in banks is not surprising, especially after the turmoil in the sector. KRE is the worst performing unleveraged equity ETF so far this year among about 2,000 of such funds that Bloomberg Intelligence tracks.

Shorting both funds, in fact, has been profitable in May, with KRE shorts up $305 million and XLF higher by $209 million, according to Ihor Dusaniwsky, S3 Partners’ managing director of predictive analytics. But that may not be the only reason.

“It feels like the ETFs are being used not only for outright bets, but a hedging for managers that own underlying bank shares,” said Dave Lutz, head of ETFs at JonesTrading. “I would note that KRE is a extremely crowded short, if not the biggest short in the market right now. Squeeze risk is very high, as any positive headlines could cause a scramble to cover, as evidenced by this a.m.’s quick move higher.”

Shares of Western Alliance Bancorp edged higher after the bank revealed Wednesday morning that deposits had grown by more than $2 billion since the quarter’s end, easing worries about the health of regional lenders. Peer PacWest Bancorp also advanced.

KRE is up 7.2% as of 1:28 p.m. in New York, while XLF is edging 2.1% higher.

Still, the regional banking meltdown “may just be pausing,” Jake Jolly, head of investment analysis at BNY Mellon Investment Management, said. “Concerns around banking sector exposure to [commercial real estate] is likely one culprit underpinning the ongoing weakness and fueling bets on further downside.”

The concerns haven’t prevented hedge funds from snapping up KRE though. The fund was a top buy among hedge funds last quarter even as it fell 25%. There were 16 that cut or exited positions, while 50 added shares, according to Bloomberg’s analysis of 13F filings by 1,099 hedge funds.

--With assistance from Vildana Hajric and Sam Potter.