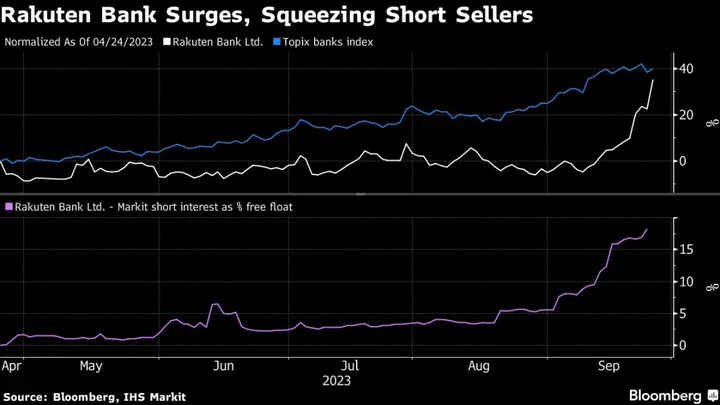

Hedge funds betting against Rakuten Bank Ltd. are getting burned after Japan’s newly listed lender soared 30% this month.

Speculation the company will benefit from a rising interest rate environment pushed up the stock, with gains accelerating as short sellers rushed to unwind their positions at increasingly higher prices. Short interest as a percentage of the free float accumulated this month, hitting an all-time high of 18.2% as of Sept. 25, data compiled by IHS Markit Ltd. showed.

“Short sellers repurchasing shares at a loss looks like it’s ignited a jet engine,” said Ikuo Mitsui, a fund manager at Aizawa Securities Co. Some investors have been wrong-footed and incorrectly expected the price would fall because of the upcoming end of a lock-up period for sales by major stakeholders.

The lock-up period for Rakuten Bank, which debuted in April, is set to expire mid-October. The stock had been trading in a narrow range until an interview with Bank of Japan chief Kazuo Ueda earlier this month set off speculation that the BOJ’s negative interest rate policy may end sooner than previously thought. That in turn sparked a rally in the nation’s lenders on expectations such a shift would boost their profitability.

Rakuten Bank shares fell 8.6% as of 12:47 p.m. on Wednesday, its biggest decline since its listing, providing some relief to those who are still shorting the company.

Japan Banks Surge With Yields on Ueda Comments on Negative Rates

Rakuten Bank’s interest rate sensitivity is relatively high among peers as a large proportion of its assets such as mortgages correlates with short-term rates, Morgan Stanley analysts Mia Nagasaka and Takuto Toyama wrote in a note dated Sept. 22.

Shorts positions had also built up on speculation of an additional share sale by Rakuten Bank and concern over its parent’s financial health, said Aizawa Securities’ Mitsui. Once all the short positions are unwound, the stock may return to range-bound trading, he said.

(Adds share move in fifth paragraph)