The selloff in emerging markets has been so severe this year that short sellers are signaling they’re done.

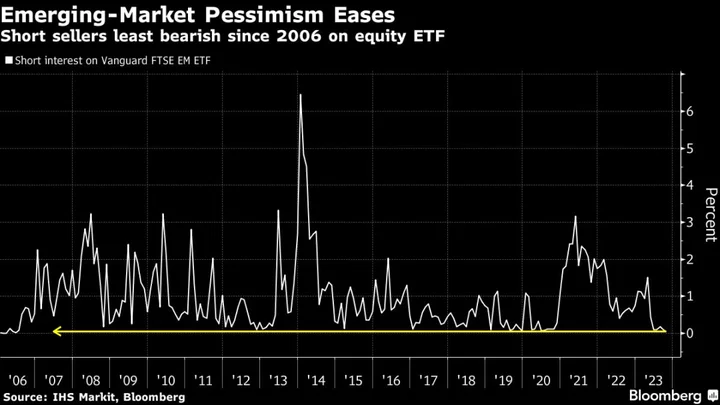

Short positions on the Vanguard FTSE Emerging Markets Exchange Traded Fund have dwindled to 0.01%, the lowest level since July 2006, according to data from IHS Markit.

It’s a data point that speaks to the extreme pessimism on stocks, especially given the backdrop of high interest rates, China’s property crisis and Israel’s war against Hamas. To some investors, low levels of short selling can be interpreted as a positive sign, essentially evidence that bears don’t see scope for more declines.

The MSCI Emerging Markets Index has dropped about 4% in 2023, putting it on track to underperform the S&P 500 Index for a sixth year. The steepest declines have been since July, which wiped off about $2.6 trillion from the value of stocks in developing nations.

Short sellers jumped on the emerging markets ETF early in the year, when trouble at US banks sparked concern about the stability of the financial system and a strong economic recovery in China failed to materialize.

The bullish case for emerging markets is centered around a belief that pessimism is overdone and the Chinese economy can recover. Industrial companies in China saw profits rise in September for a second straight month, in a further sign that policy support is helping the manufacturing sector recover, according to a National Bureau of Statistics report on Friday.

Some analysts are also calling for profits to improve in developing nations. The average estimate for earnings over the next 12 months has climbed to the highest level since Aug. 10, data compiled by Bloomberg show.