Supply Lines is a daily newsletter that tracks global trade. Sign up here.

The container shipping industry’s year-long slump shows preliminary signs of turning the corner, though it’s not clear yet if a rebound is sustainable, the chief of Europe’s fourth-biggest carrier said.

“The market is definitely still not strong but I think we see some signs of stabilization,” Hapag-Lloyd AG Chief Executive Officer Rolf Habben Jansen said in an interview. “We’ve seen just a bit of an uptick as we anticipated — now we need to see how long that holds.”

He spoke after the Hamburg, Germany-based company announced that demand was subdued in the first half and confirmed its full-year forecast published in March. The shares were down about 5% in midday trading.

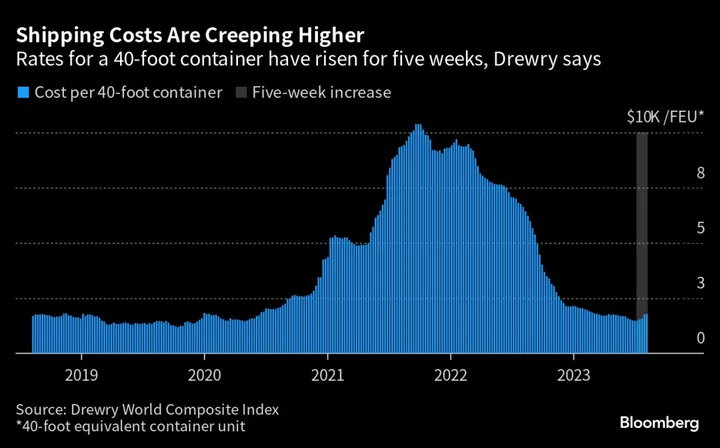

Ocean-cargo companies that haul four-fifths of the world’s merchandise trade brought in windfall profits in 2021 and early 2022 as consumer demand for goods surged, clogging ports and squeezing ship capacity. Hapag-Lloyd, A.P. Moller-Maersk A/S and other carriers have since watched record-high spot rates for containers tumble eightfold from their 2021 peak.

Though demand softened earlier this year as companies let inventories wind down, “we also see some green shoots,” Jansen said Thursday. “At the moment, we see a reasonably normal peak season and the underlying fundamentals of the global economy are still not that bad — not only in the US, but also certainly in a number of the emerging markets.”

He added, “when I look out in the mid-term, I’m not that pessimistic.”

That sounds less gloomy than the outlooks expressed recently by some of Hapag-Lloyd’s biggest rivals.

Copenhagen-based Maersk last week lowered its estimate for global container trade, with CEO Vincent Clerc citing “a really subdued environment that will continue for the rest of this year.”

A week earlier, France’s CMA CGM SA said “the transport and logistics market remains depressed,” and sluggish economic growth and persistent inflation were expected to weigh on consumer spending for the rest of the year.

Jansen said he’s seeing “somewhat of a recovery in demand” as the industry moves closer to peak season — which typically runs from August to October as retailers and other importers order more goods for back-to-school and year-end holiday shopping.

“If I look at the last 10 or 12 weeks, we have certainly seen some better loading, also compared to last year, and you also see some recovery on the spot rates on some of the main lanes,” he said, referring to short-term prices for containers. “Whether that’s going to be a very strong peak season remains to be seen.”

The Drewry World Container Index composite increased 1.7% to $1,791 for a 40-foot container, the fifth consecutive weekly advance. That’s the longest streak of gains since January 2022. The composite reflects short-term rates across eight trade routes connecting Asia, Europe and the US.

Xeneta AS, an Oslo-based shipping-analytics company, said Thursday that spot rates compiled on its platform have risen back above longer-term contract rates — a reversal that puts importers and other cargo owners that shift between the two markets in a tougher position.

“Many of the shippers who have been taking advantage of the weak short-term market and delaying signing new long-term contracts will be eying developments nervously,” Xeneta chief analyst Peter Sand said in an emailed statement. “Have they left it too late to negotiate? Has the market bottomed out before a rebound? Or is this simply a false dawn for carriers?”

Read More: Global Shipping Costs Creep Higher After 16-Month Freefall

Jansen said he hoped inflation continues to come down in the next three to six months. But he reiterated that over longer term, container rates will have to adjust higher because carriers face steeper expenses — from charter rates to different types of fuel — than they did before the pandemic.

“Cost these days are structurally higher than what they were in 2018-2019, so to take those rates as a benchmark is just not the right reference point,” he said. “So over time, rates must stabilize at a higher level than what they were before.”