By Marc Jones

LONDON The bulls remained in charge on Thursday as bets that major central banks are now done with rate hikes and the recent slide in oil prices kept global borrowing costs near their lowest levels in months.

Wall Street was looking to extend an eight-day winning streak later while Europe was in an upbeat mood too, with its shares hitting a three-week high and oil prices rebounding, but the dollar, euro and yen barely budged. [.EU][/FRX][O/R]

Government bonds were moving only slowly too, with the head of the U.S. Federal Reserve due to speak again later and China having reported another dip in its inflation rate overnight.

Germany's benchmark 10-year borrowing cost was 5 basis points (bps) up from a two-month low of 2.6% hit on Wednesday with the equivalent U.S. Treasury note in a similar position at just under 4.5%.

"I think inflation is yesterday's story," said Pictet Asset Management's Chief Strategist Luca Paolini, explaining the "big question" now was whether there would be a sharp deceleration in the U.S. economy in the coming months.

"We are bullish on bonds," he added. "We think this is the beginning of a long and positive move."

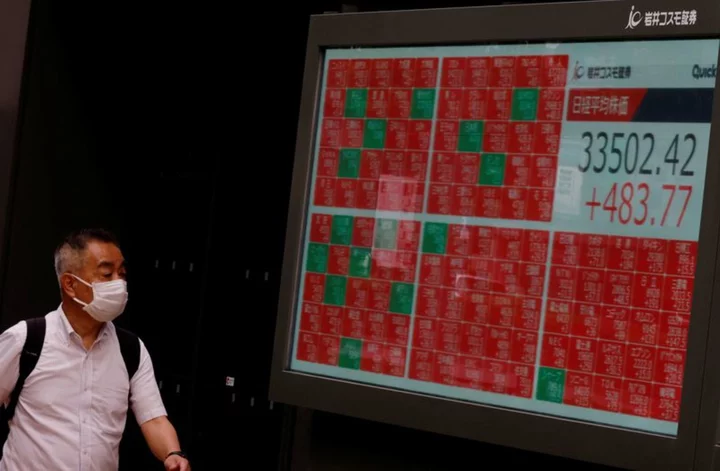

In Asia, Japan's Nikkei raced up 1.5% thanks to solid earnings from Super Mario maker Nintendo and calculator and watch firm Casio and broad-based gains in the oil sector. [.T]

China's property sector woes boomeranged back, though, with the main Hong Kong listed real estate index down 4% as embattled property giant Country Garden plunged nearly 10% on a blow to its rescue hopes. [.SS]

Chinese inflation figures for October also showed a 0.1% decline compared to September and a 0.2% year-on-year fall, pointing to still fragile demand in the world's second biggest economy.

"I think for equities investors, they are still shying away from Chinese property because there are so many unknowns," said Jason Lui, BNP Paribas's Head of APAC Equity & Derivative Strategy.

"Property needs to stop being a drag on GDP and sentiment so investors can move on to the real growth drivers."

WINNING STREAK

Wall Street futures for the S&P 500 were up around 0.2% after eight days of uninterrupted gains from the flagship index which is on its best run in almost exactly two years. [.N]

The dollar was fractionally higher at 151.1 yen and $1.0695 to the euro. The dollar index, which tracks the greenback against a basket of currencies of major trading partners, inched up too, having risen around 2.5% since early October.

The dollar has rebounded from last week's sharp sell-off on rising confidence the Fed has ended raising rates. There is less agreement on whether a rate cut is on the horizon, a new Reuters poll showed with inflation still above its 2% target.

The Fed last week kept the benchmark overnight interest rate in the current 5.25%-5.50% range and the central bank is due to meet again mid next month.

U.S weekly jobless claims published on Thursday will be closely watched as an indicator of the how the country's labour market is performing. Economists predict claims will reach 219,000 after coming in at 217,000 last week.

In commodity markets, oil prices were up nearly 1%, having slid more than 2% on Wednesday to their lowest in more than three months on concerns over waning demand in the U.S. and China.

In European trading, U.S. crude ticked up to nearly $76 a barrel as Brent crude rose to just above $80.

Safe-haven gold was slightly lower at $1948.93 per ounce, having spiked 10% after last month's outbreak of war between Israel and Hamas. [GOL/]

"We tend to forget one month ago everyone was panicking about the news coming from the Middle East but look at where the oil price is now," Pictet's Paolini said. "The markets are cynical".

(Additional reporting by Scott Murdoch in Sydney; Editing by Mark Potter, Kirsten Donovan)