Deflation in Seychelles is expected to be short-lived because of a weaker currency and higher import prices, the central bank said.

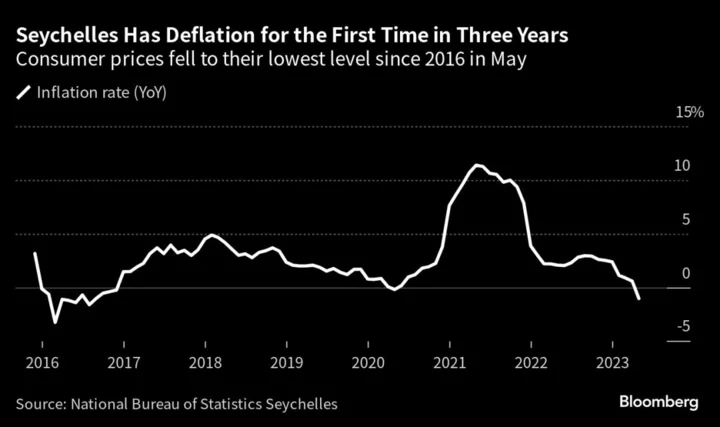

The tourism-dependent Indian Ocean archipelago is the only nation in Africa besides Burkina Faso to report a general decline in the cost of goods and services in May, making it an outlier at a time when most nations are battling persistent inflation. Consumer prices fell an annual 1% last month, compared with a 0.6% rise in April.

“Inflationary pressures are projected to materialize in the medium term, driven by an anticipated increase in domestic demand and a weaker exchange rate,” the Victoria-based Central Bank of Seychelles said in an e-mailed response to questions on Friday. “Global commodity prices are expected to contribute to inflationary pressures through higher import costs.”

After reaching a 2023 high of 12.7993 against the dollar on March 9, the Seychellois rupee has since depreciated 8%, partly due to reduced foreign-currency inflows.

Tourism receipts declined 14% in April and May, despite visitor numbers increasing, Governor Caroline Abel said on Wednesday, when the central bank kept the benchmark interest rate at 2%, a record low.

The industry may be adversely impacted by global challenges such as the war in Ukraine, tight monetary conditions and a recession in the euro area, a big source of visitors to the island, she said.

“Given the global conditions and uncertainties that this brings, the bank considered it essential to continue supporting the domestic economy as it remains highly susceptible to external shock,” it said in emailed comments.