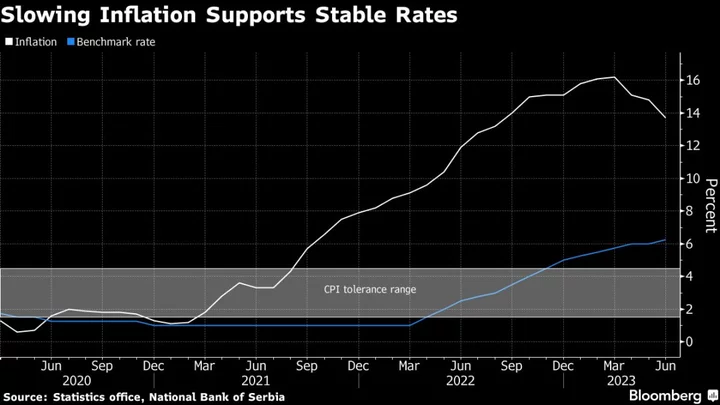

Serbia will probably leave borrowing costs unchanged as inflation continues to ease and the central bank extended its currency intervention to keep the nation’s dinar from gaining.

The National Bank of Serbia is set to hold the key rate at 6.25% on Thursday, according to 12 out of 13 economists in a Bloomberg survey. One predicted the rate would rise by a quarter percentage-point. The meeting follows a surprise increase last month, which brought the benchmark to the highest level since 2015 in a cycle of 14 hikes, interrupted only in May.

The Balkan nation’s annual inflation slowed to 13.7% in June, more than expected, and price growth is now on track for an expected return to single digits later this year.

The central bank is also facing appreciation pressures on the dinar, which it’s fighting off with market interventions to keep the currency in a tight range against the euro. It bought a cumulative €1.86 billion in the first half of the year.

Raiffeisen Banka AD in Belgrade expects no change in July, but its chief economist, Ljiljana Grubic, said that a hike is still possible because of growing money supply, spending on public wages and pensions. Uncertain agriculture output due to changing weather conditions and a potential desire to keep an attractive interest-rate differential against US borrowing costs may also play a role.

“Fiscal policy could have inflationary effects once application of the measures begin,” Grubic said.

--With assistance from Harumi Ichikura.