The Treasury yield curve has become far less inverted this week, but the shift is unnerving investors as it comes through a painful selloff in longer bonds rather than the rally in shorter debt most expected.

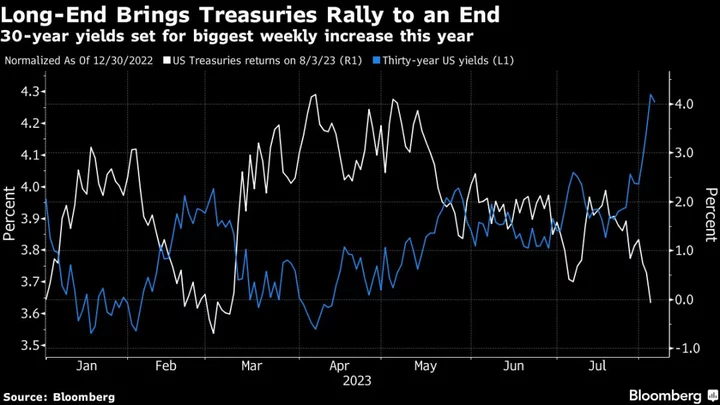

Yields on 30-year bonds climbed above their five-year peers Thursday for the first time since June as long bonds headed for their worst week since December. The slide in longer debt is pushing some investors to abandon bets the sector would outperform as Federal Reserve policy tightening leads to a recession.

Instead, resilient economic data and better-than-forecast earnings are persuading traders the Fed will tame inflation without a severe slowdown, leading them to demand higher yields to own longer maturities. The long end is also being pummeled by plans for increased issuance and Fitch Ratings’ move to cut its US credit ranking.

“There’s been a pretty consistent theme of ‘go with the momentum’ despite bond-friendly data showing cooling inflation pressures,” said Amy Xie Patrick, head of income strategies at Pendal Group in Sydney, who recently went neutral on longer-term debt.

“This looks like a ‘no landing’ view being reflected as the curve bear steepens,” she said. “Surely, didn’t we all expect that the next time the curve had any steepening momentum, it would be the bull steepening that signaled the start of the recession?”

A bear steepening occurs when longer-maturity yields rise faster than shorter-maturity ones. At one stage on Thursday, the 30-year yield was two basis points higher than the five-year one, after being as much as 45 basis points below it in early July. Long-bond yields have jumped 26 basis points this week, versus an 11 basis-point increase for five-year ones.

One trigger for the slide in longer debt was the Treasury’s decision to boost the size of its quarterly bond sales for the first time in more than two years this week to help finance a surge in budget deficits. The department said it would sell $103 billion of longer-term securities at next week’s quarterly refunding auctions, more than most dealers had expected.

The Bank of Japan’s decision last week to allow benchmark 10-year yields to rise above 0.5% has added to the global debt selloff.

“My suspicion is there’s some momentum left in this,” said Vishnu Varathan, executive director and head of economics and strategy at Mizuho Bank Ltd. in Singapore. “One of the drivers for that is the supply dynamics of it, with the debt overhang becoming more of a structural issue. Also because data in the US continues to be fairly upbeat, the reduction in long-end yields from recession risks has dissipated.”

Ackman Bearish

Investor Bill Ackman said this week he’s making sizable bets on declines for 30-year Treasuries, and cited plans for increased bond sales as a key concern.

Meanwhile, these are signs investors are switching funds toward shorter securities, where yields are still above 5%. Money-market fund assets climbed to a record of $5.52 trillion in the week ended Aug. 2, while Elon Musk said Thursday short-term Treasury bills are “a no-brainer.”

Given the risk Friday’s US payrolls data will add to signs of labor-market strength, even those who expect longer bonds to bounce back over the medium term are reluctant to buy just yet.

“We would be nervous about entering long positions at the long end of the curve here,” said Andrew Ticehurst, a rates strategist at Nomura Holdings Inc. in Sydney. “The other issue, which has been lurking in the background is the BOJ’s tweak. There is some global market nervousness that higher Japanese yields will mean Japanese investors keep more of their money at home.”

--With assistance from Ruth Carson.