With California’s population in decline, rising home insurance premiums threaten to intensify the exodus and further weaken state and local finances, S&P Global Ratings Inc. warns.

The ratings firm sees a retreat by insurance companies — prompted by wildfires, skyrocketing rebuilding costs and regulatory limits on rate increases — as poised to push the state’s already high homeownership costs even higher, according to a report Thursday. Reduced competition among the remaining insurers is expected to lead to higher prices and fewer options for current residents or those considering a move to California.

Last month, Farmers Insurance Co. said it would limit sales of new home insurance coverage in California. In May, State Farm General Insurance Co., the state’s biggest home insurer, said it would stop writing new policies altogether. Allstate Corp. halted the sale of new policies in the state last year.

“If insurers leave the state or if homeowners have to pay more to get insurance, that could weaken credit quality because it could dampen economic growth,” said Nora Wittstruck, an S&P analyst in a telephone interview. “Because California already leads in nominal domestic outmigration it could become a problem.”

While not unique — insurers are also leaving hurricane-prone Florida and Louisiana — California is grappling with the departure of residents spurred by the nation’s second-highest housing prices, the rise of remote work, and costly state and local taxes. California’s population declined by more than 500,000 between April 2020 and July 2022, according to the Census Bureau and led US states in outmigration over the last 10 years.

Because California’s tax collections rely heavily on capital gains revenue from high earners, it’s critical that the state’s wealthy stay put, said Jennifer Johnston, director of research for Franklin Templeton Fixed Income’s municipal-bond team.

“The question will ultimately become, as these costs increase can they continue to pay,” she said. “We still feel that there are a lot of advantages from an economic standpoint to stay here.”

Despite a severe decline in personal income tax revenue, this year’s state budget covered a $32 billion deficit without dipping into its rainy day fund. California still has about $38 billion reserves and has the ability to cut spending or offer incentives to the wealthy and businesses to stay put, Johnston said.

Read more: American States Once Awash in Cash Now Face Reversal of Fortunes

Drought, extreme heat, and the expansion of homebuilding in rural areas, has increased the threat of wildfires. California’s Department of Forestry and Fire Protection reported that nine of the 20 largest wildfires on record by acreage occurred in 2020 and 2021 with more than 4 million acres burned.

In California there have been five wildfires between 2018 and 2022 that cost between $50 billion and $100 billion, according to the National Centers for Environmental Information.

It’s not clear that wildfire risk by itself is spurring migration, though.

“We’re still hearing about record sales in the Lake Tahoe area, so I think we don’t quite know yet what the impact is going to be,” Johnston said.

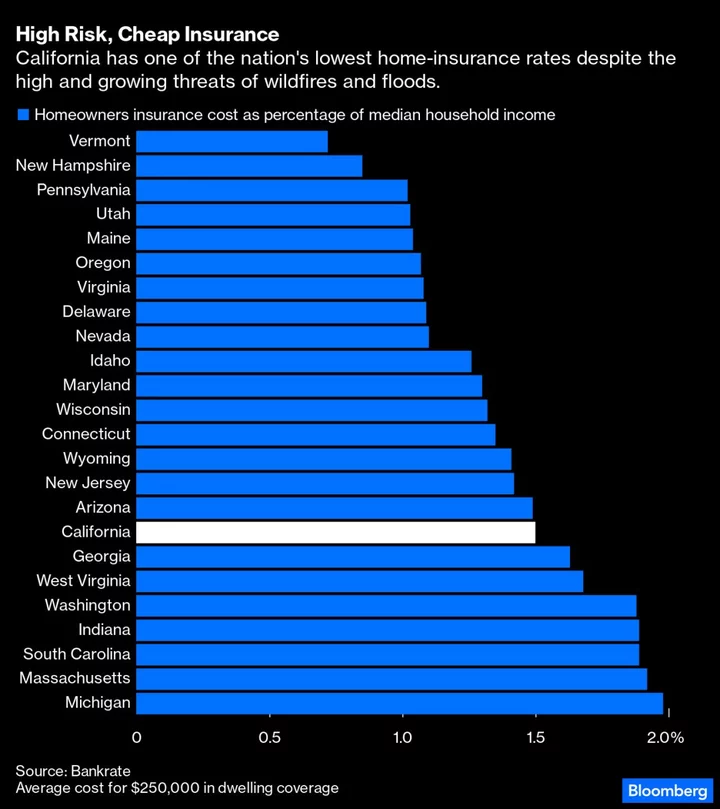

In a bid to to make insurance affordable to consumers, state regulators often limit annual rate increases. California’s Department of Insurance requires a public hearing when an insurer applies for an increase of 7% or more. Despite growing risks from drought, extreme heat, wildfires and flooding, the state has one of the nation’s lowest home-insurance rates on average.

“Extreme weather events are leading to higher claim payments and insured losses overall,” Wittstruck said. “These caps that insurers are running up against really make it unprofitable for them to operate in the state.”

The average annual home insurance premium in California is $1,300, an 16% increase from 2019, according to the Insurance Information Institute. By contrast, Florida premiums have tripled to $6,000.

S&P said it expects natural disasters could continue to reduce insurance availability in California.

--With assistance from Mark Gongloff.

Author: Martin Z. Braun