A Russian missile strike on a commercial ship at a major Ukrainian Black Sea port is adding to risks for commodity exports just as farmers in the war-battered nation are in the midst of this year’s harvest.

A 750-feet iron ore carrier, the KMAX Ruler, was hit near Ukraine’s key port of Odesa Wednesday, inflicting what the United Nations said was the first civilian casualty of a mariner since the war began. The incident highlighted the perilous risks for every type of vessel sailing to a country that’s under bombardment from Moscow’s forces.

Ukraine is collecting larger-than-expected crops of key staples like corn, much of which typically is sold abroad, despite Russia’s invasion. Burdensome logistics costs have already left farmers squeezed — and any downturn in exports or spike in shipping costs could make matters worse. A trickle of metal shipments may also be in jeopardy.

The strike killed the pilot and injured others as the vessel prepared to load iron ore for China, according to Ukrainian authorities. The government in Kyiv said Thursday that ships continue to move, although the strike adds to safety concerns and could raise costs.

The UN’s humanitarian coordinator for Ukraine, Denise Brown, condemned what she said was the first wartime death aboard a civilian vessel — and a violation of international law.

“The consequences of this brutal and relentless pattern of Russian attacks on port facilities are devastating for Ukraine’s economy and the hundreds of millions of people facing hunger worldwide,” Brown said in a statement.

Alexandre Marie, chief analyst at Paris-based adviser Agritel, said the incident “is not good news for the navigation security,” adding insurance premiums and freight costs could spike.

The attack took place at the port of Pivdennyi near Odesa. The Black Sea hub is key to the new commodity-export corridor Ukraine has opened after Moscow left a grain deal ensuring safe crop transit in July.

Bound for China

Infrastructure Minister Oleksandr Kubrakov sought to reassure the public and traders, saying that six vessels carrying some 231,000 tons of agricultural goods left Odesa-area ports, while five were waiting to enter.

“Traffic along the Ukrainian corridor continued despite Russia’s systematic attacks on port infrastructure,” Kubrakov said on social platform X. Since early August, 91 vessels carrying more than 3 million tons of agriculture and metal cargoes have been exported via the corridor, he said.

That’s in addition to crop flows moving from smaller ports on the Danube River and road and rail routes via the European Union.

While Ukraine’s grain shipments have waned since the invasion started last year, it remains a major global supplier and is forecast to export about 50 million tons of grain and oilseeds in the 2023-24 season. The harvest has been running ahead of last year’s pace.

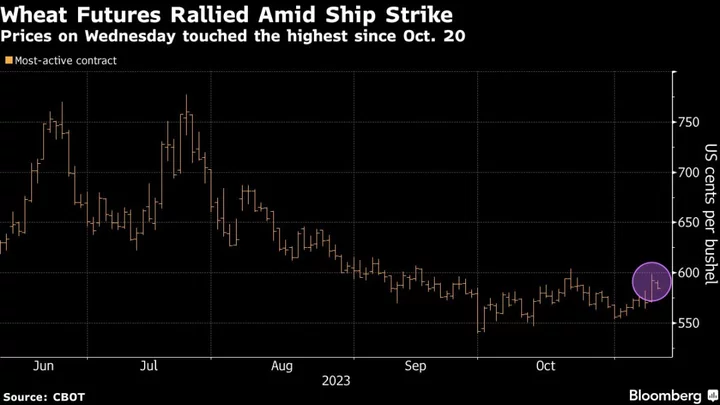

Wheat futures in both Chicago and Paris eased on Thursday, after reaching two-week highs during the prior session.

Ukraine also accounted for about 1% of the global seaborne trade in iron ore before the war, but those shipments have now all but collapsed, according to data from Clarkson Research Services Ltd., a unit of the world’s largest shipbroker. It exported about 17.4 million tons in 2021 but is likely to load only 300,000 tons onto ships this year, the firm estimates.

The ship was due to pick up iron ore from ArcelorMittal SA, but was struck before loading began, a company spokesperson confirmed.

The vessel has a transportation capacity of about 90,000 tons, according to ship tracking compiled by Bloomberg and a person with knowledge of the matter.

China, the ship’s destination according to Ukrainian authorities, is the world’s top importer of the steel-making raw material, the price of which is closing in on $130 a ton for the first time since March.

--With assistance from Alaric Nightingale, Eddie Spence, Volodymyr Verbianyi, Olesia Safronova and Megan Durisin.

Author: Kateryna Chursina, Celia Bergin and Áine Quinn