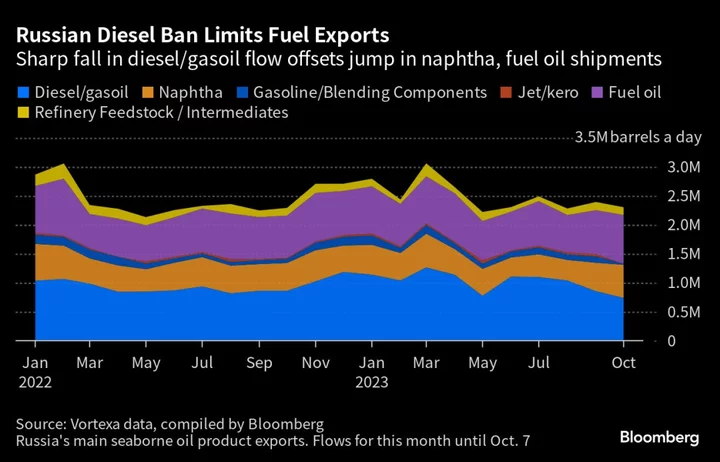

Russia’s exports of oil products declined in the first week of October, with diesel flows dropping to a three-year low amid a ban on some shipments of the fuel for most of the period.

Diesel exports began to pick up after Oct. 6, when Moscow lifted its block on outflows of high-quality grades last month to stabilize domestic supplies. Shipments of naphtha and fuel oil increased during the week.

The oil market is closely watching Russian exports to estimate its crude production after Moscow classified official output data. Seaborne crude oil flows slipped in the seven days to Oct. 8, according to tanker-tracking data monitored by Bloomberg. Meanwhile, seasonal maintenance cut refinery rates to a 19-week low, curbing fuel exports in recent weeks.

Refined petroleum product exports dropped to about 2.3 million barrels a day in the first week of October, down 91,000 barrels a day from the previous month, according to data compiled by Bloomberg from analytics firm Vortexa Ltd. Still, fuel flows remain marginally above the daily average for the same month seen last year.

Here’s a breakdown of exports from Russia’s ports for the Oct. 1-7 period:

Shipments of Russian diesel and gasoil have tumbled to just 740,000 barrels a day, the lowest in three years, according to Vortexa data. While only high-quality diesel outflows were temporarily banned, overall flows of both diesel and gasoil shrank amid peak refinery works.

Naphtha exports jumped 16% on a monthly basis to about 570,000 barrels a day, the highest since March. Shipments have climbed since last month with a surge in flows to Asia.

Gasoline and blending component flows slumped to just 17,000 barrels a day. Volumes dropped to the lowest since January 2017, amid the ban on the car fuel exports. No jet fuel cargoes were observed.

Russian exports of fuel oil surged by 11% this month to 843,000 barrels a day, the highest since February 2022. The bulk of shipments are heading toward Asia. Refinery feedstock flows, like vacuum gasoil, have eased on a monthly basis to 134,000 barrels a day.

Cargo volumes and destinations are likely to be revised as more shipments are observed for the rest of the month.