Russia’s central bank raised interest rates to the highest in over a year, increasing the pace of monetary tightening at an emergency meeting called after one of the steepest depreciations in emerging markets cast a pall over the economy.

Policymakers lifted their benchmark to 12% from 8.5%, the second straight increase and the sharpest since the immediate aftermath of Russia’s invasion of Ukraine almost 18 months ago. The meeting was brought forward by a month after the ruble briefly broke through 100 to the dollar for the first time since March last year.

“The decision is aimed at limiting price stability risks,” the central bank said in a statement. Policymakers provided no further guidance and said they next plan to review borrowing costs on Sept. 15.

The ruble appreciated after the rate announcement before reversing gains and trading weaker against the dollar. It’s still among the three worst performers in developing economies this year with a loss of over 24%.

The decision on Tuesday took a page from a playbook that Governor Elvira Nabiullina used in the past when the ruble foundered, after an announcement the central bank would refrain from foreign-currency purchases last week failed to arrest the rout and a top Kremlin official pinned the blame on the central bank’s “soft” policy.

“Hiking policy rates won’t solve anything,” said Timothy Ash, senior emerging-market sovereign strategist at RBC Bluebay Asset Management. “They might temporarily slow the pace of depreciation of the ruble at the price of slower real GDP growth — unless the core problem, the war and sanctions, are resolved.”

Grievances Aired

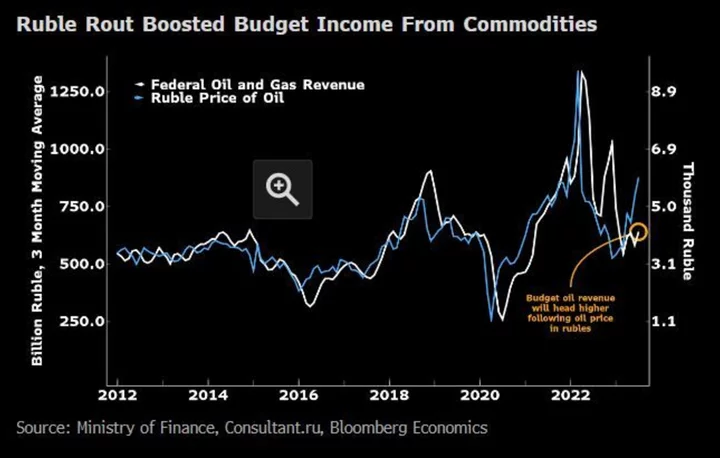

The rare public infighting offered a glimpse into the competing priorities driving Russian economic policy. Though a weaker ruble is a boon for government income as revenue from oil exports soared to an eight-month high, it’s also driving up the cost of imports and encourages locals to seek safety by shifting money outside the country.

A weaker ruble dramatically accelerated the timeline for monetary tightening, with economists polled by Bloomberg in late July expecting the key rate to rise to no higher than 9% this quarter.

Just over three weeks ago, the central bank delivered a hike of a full percentage point after long warning that higher rates were on the way in response to inflationary risks from heavy government spending, sanctions and labor shortages caused by the war.

But the stakes rose much higher this month, with the economy drained by capital outflows and annual inflation that exceeded the central bank’s 4% target for the first time since February.

What Bloomberg Economics Says...

“The Bank of Russia’s strategic surprise is an attempt to increase savings in the local currency and increase the credibility of its 4% inflation target. The central bank may put policy rate changes on pause through the rest of 2023.”

—Alexander Isakov, Russia economist.

The urgency for Nabiullina became even greater after President Vladimir Putin’s adviser chastised the central bank on Monday, blaming it for allowing faster lending growth to flood the economy with money and calling for a “strong ruble” to help Russia adjust.

Other prominent voices seized on the depreciation as a threat to social stability that made Russia appear vulnerable at a time when the war in Ukraine grinds on and international sanctions hit trade.

Policymakers are counting on the rate hike to boost the appeal of domestic savings and cool off consumer demand that’s contributed to a deterioration in foreign trade and helped bring the current-account surplus to its lowest in two years.

It’s unclear if the central bank has done enough to iron out the differences that have emerged in the highest echelons of the Russian establishment.

Although Kremlin economic aide Maxim Oreshkin said the Bank of Russia “has all the necessary tools to normalize the situation in the near future,” its options are limited beyond keeping rates elevated and tightening capital controls.

With much of the central bank’s reserves already frozen by sanctions, policymakers will be reluctant to wade into the currency market with direct interventions if the ruble comes under pressure again.

“Steady growth in domestic demand surpassing the capacity to expand output amplifies the underlying inflationary pressure and has an impact on the ruble’s exchange-rate dynamics through elevated demand for imports,” the central bank said. “Consequently, the pass-through of the ruble’s depreciation to prices is gaining momentum and inflation expectations are on the rise.”

(Updates ruble’s performance, adds analyst comment in sixth paragraph.)