Russia’s central bank raised interest rates far more than forecast, alarmed that inflationary risks are still on the rise even after a reimposition of capital controls took pressure off the ruble.

Policymakers on Friday lifted the benchmark for a fourth straight time, bringing it to 15% from 13%. Governor Elvira Nabiullina is scheduled to hold a news conference at 3 p.m. in Moscow.

The decision brings borrowing costs to the highest since April 2022 and risks tipping the economy into recession. But stabilizing the ruble to get a better grip on inflation has emerged as a key priority for Russia at a time when Vladimir Putin prepares for presidential elections while the war against Ukraine rages into a 21st month.

An additional tightening of monetary policy is needed “to limit the upward deviation of inflation from target and return it to 4% in 2024,” the central bank said in a statement, without indicating if its next move is more likely to be a hike rather than a decrease.

“Current inflationary pressures have significantly increased to a level above the Bank of Russia’s expectations,” it said. The ruble extended gains versus the dollar after the rate announcement.

The central bank also issued updated forecasts that showed inflation will be faster than first anticipated — ending this year in a range of 7%–7.5% — and projects a higher trajectory for rates. The outlook also suggested for the first time that price growth could exceed the target next year.

Longer Cycle

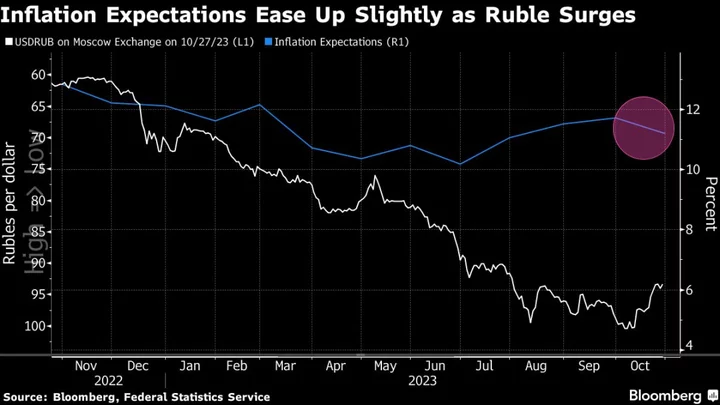

Despite the world’s biggest currency rally over the past month, the central bank is extending a cycle of monetary tightening that began in July when the pace of the ruble’s depreciation was just picking up. The exchange rate later weakened to levels unseen since the aftermath of last year’s invasion of Ukraine.

The government’s decision this month to put up tighter restrictions on the movement of capital, a move initially opposed by the central bank, has succeeded in halting what’s still one of the steepest depreciations in emerging markets in 2023.

But the move came too late to reverse the momentum of inflation that far exceeds the official 4% target. And despite its rally, the ruble has still lost about a fifth of its value against the dollar so far in 2023.

“The high pace of inflation and credit volume growth cannot but fuel the central bank’s concerns and desire to bring down the temperature of market expectations a little more” said Sofya Donets, an economist at Renaissance Capital.

The October announcement by the government — which requires major exporters to sell their foreign earnings on the domestic market for rubles — set down measures that will extend over the next six months, a period encompassing Putin’s campaign for a fifth term in elections scheduled for March.

The stiffer rules bolster the supply of hard currency for an economy drained by capital outflows and a decline in export proceeds. The ruble, which earlier crossed the symbolic 100 per dollar threshold, has gained about 5% since the regulations went into effect, recently trading below 94 against the US currency.

Inflation expectations, which play a critical role in shaping rate decisions, already declined in October for the first time in four months.

A 10% decline in the ruble pushes up inflation by 0.5 to 0.6 percentage point, according to Bank of Russia estimates. The central bank’s analysts have warned that price growth in recent weeks “has followed the high trajectory of 2021” and may exceed the current official forecast of 6%-7% that’s just been upgraded.

Though the government’s reinstatement of capital controls should steady the ruble while consumer lending slows, Barclays Plc reversed its call for a hold this week and forecast a hike because rates at their current level may not have been “sufficient to bring inflation to the 4% target by the end of 2024.”

Since the last meeting in September, “inflation has continued to accelerate amid still-strong domestic demand and high ruble volatility,” Barclays economists including Brahim Razgallah and Zalina Alborova said in a report before the decision.