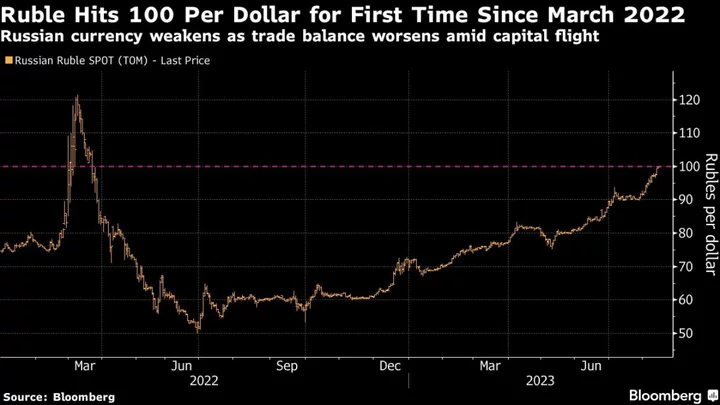

The ruble broke through the psychologically important level of 100 to the dollar for the first time since March last year, even after Russia’s central bank sought to arrest the slump by halting its foreign-currency purchases on the domestic market for the rest of 2023.

Russia’s currency has weakened by about 25% against the dollar so far this year, placing it among the three worst emerging-market performers with the Turkish lira and the Argentine peso. It’s almost halved in value from its peak in June last year as President Vladimir Putin’s invasion of Ukraine grinds on with no end in sight and sanctions including an oil price cap slash revenue from exports.

The central bank announced Wednesday that it would stop buying foreign currency on the domestic market under a budgetary mechanism that was put in place to insulate the economy from swings in commodity prices. The decision aimed to “reduce the volatility of financial markets,” it said.

What Bloomberg Economics Says...

“To stabilize the ruble, we estimate the policy interest rate needs to rise closer to 10% and federal budget spending must be kept within the fiscal ceiling. The ruble may benefit from higher crude oil prices, but domestic monetary policy will remain a more reliable anchor for the currency. The Bank of Russia will need to hike the policy rate by 50-100 basis points at its Sept. 15 meeting to boost domestic savings and reduce imports.”

—Alexander Isakov, Russia economist. For more, click here

Revenues of Russian oil and gas exporters declined to $6.9 billion in July from $16.8 billion in the same period last year, according to the latest central bank data. An easing of restrictions on moving money abroad has also led to accelerated capital flight as Russians race to shift funds into foreign accounts.

Central bank Governor Elvira Nabiullina has repeatedly pointed to the deterioration in foreign trade conditions as the main reason for the ruble’s weakness, while ruling out intervention to support the exchange rate.

“We don’t see any risks to financial stability” from the ruble’s decline, Bank of Russia Deputy Governor Alexey Zabotkin told reporters Friday. The central bank continues to adhere to a floating exchange-rate policy which “allows the economy to adapt effectively to changing external conditions,” he said.