A group of companies controlled by an influential member of Abu Dhabi’s royal family have shed $30 billion in market value this year, contributing to a drop in the emirate’s benchmark index that’s lagged regional peers.

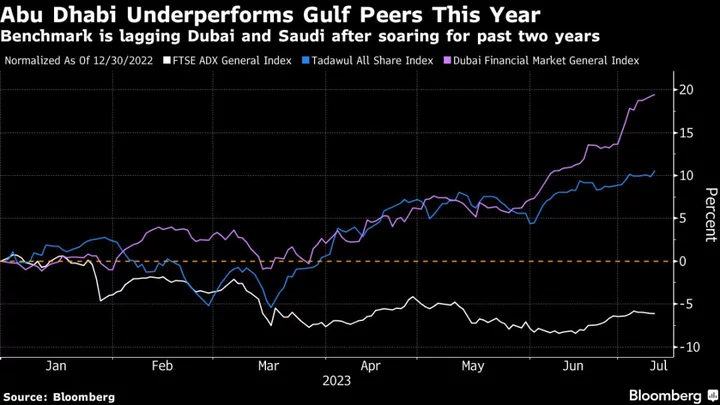

Abu Dhabi’s FTSE ADX General Index is down about 6% year-to-date, significantly under-performing benchmarks in Dubai and Riyadh, which have both risen more than 10%. That’s due in part to a near 4% drop in International Holding Co., the $236 billion conglomerate chaired by United Arab Emirates National Security Adviser Sheikh Tahnoon bin Zayed Al Nahyan.

IHC’s shares have rallied in recent years, helping the Abu Dhabi bourse post gains of close to 100% since the start of 2021. IHC’s units, Alpha Dhabi Holding Co. and Multiply Group, have also dropped more than 20% in 2023 after two years of significant gains.

“The current performance of the Abu Dhabi Stock Exchange is partly associated with profit booking on companies that have seen significant gains, including IHC and newly-listed stocks,” said Junaid Ansari, head of investment strategy and research at Kamco Invest.

First Abu Dhabi Bank, the country’s largest lender that’s chaired by Sheikh Tahnoon, is also down by a fifth this year. IHC, FAB, Alpha Dhabi and Multiply together account for just under 60% of the emirate’s benchmark index based on the most recent weightings.

“It’s plausible for a company to exhibit commendable operational and financial performance yet witness a drop in its stock price,” a representative for IHC said. The UAE economy remains robust, but uncertainties in some global markets where Alpha Dhabi and Multiply hold assets have contributed to the drop in their stock prices, the spokesperson said.

Read more: World’s Richest Family Rides 28,000% Stock Surge to $300 Billion

With investments ranging from Elon Musk’s SpaceX to a local fishery and Abu Dhabi’s largest property developer, IHC is at the forefront of a drive to diversify the economy of UAE and deploy its oil windfall overseas.

Its shares have risen about 42,000% since 2019, propelling the firm into the leagues of the world’s largest, though the firm hasn’t been included in the global MSCI index. IHC, Alpha Dhabi and Multiply aren’t covered by analysts tracked by Bloomberg.

IHC is controlled by Royal Group, a conglomerate that lists Sheikh Tahnoon — brother to the UAE’s president — as its chairman. Sheikh Tahnoon is also chairman of the $790 billion Abu Dhabi Investment Authority and smaller wealth fund ADQ.

Read More: Top UAE Royal Adds $790 Billion Fund to Sprawling Empire

(Updates with comment from IHC in 6th paragraph.)