Hundreds of millions of euros heading into Romania during a major share offering are set to add pressure in the coming weeks to the local currency market, where any sharp moves in the leu have been tightly controlled by the central bank.

The leu will probably see inflows when foreign investors exchange funds to buy local shares in power producer Hidroelectrica SA, whose offering is estimated at as much as 8.7 billion lei ($1.9 billion) and is expected to close on July 4.

The expected move in the leu is set to test the central bank’s tolerance for moves in the currency. The authority will likely step in to temper the appreciation and keep the leu stable below or close to 5 against the euro this year, according to economists.

The Romanian central bank declined to comment, as part of their regular practice of not commenting on currency moves.

“It is reasonable to assume that out of the more than €1 billion estimated inflows from institutional investors, a fair size will be fresh money into the Romanian market,” said ING Bank Romania economist Valentin Tataru.

Closed-end fund Fondul Proprietatea SA, which is managed by Franklin Templeton Investments, is seeking to sell about 17.3% of its 20% holding in Hidroelectrica on the Bucharest Stock Exchange. The largest part of the stake is offered to institutional investors and only 15% to retail investors. Demand already exceeds the full deal size throughout the price range, according to terms of the deal seen by Bloomberg News.

“Given the limited depth of the local FX market, a transitory appreciation of the leu could be envisaged and might test the central bank’s limited tolerance for downside EUR/RON moves,” ING’s Tataru said.

Tataru sees “the 4.92 area as a good support level” for the leu and predicted the currency will weaken slightly to 5.02 against the euro by the end of the year.

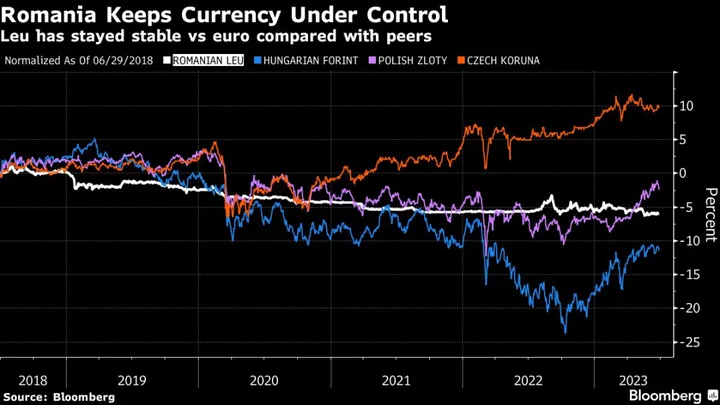

The leu has been one of the most stable currencies this year in eastern Europe under the central bank’s managed floating regime. Neighboring Hungary’s forint weakened to a record low last year amid a dispute with the European Union over funding, before paring a large part of the losses in volatile trading.

To be sure, the leu has recently gone through a weakening spell as well, hitting a record low last month after the central bank signaled it will allow more flexibility as part of a move aimed at curbing a recent jump in foreign-currency loans. It has since rebounded to trade at around 4.96 against the euro.

“We’ve had the most stable exchange rate in the region, barring some episodes of ups and downs and I think we’ll see such an episode this summer, as the Hidroelectrica IPO will help with inflows,” BRD-Societe Generale SA Deputy Chief Executive Officer Claudiu Cercel told a banking summit in Bucharest this week. “But this is just conjecture, and excluding these factors, I think we’ll see a stable currency and the leu will stay below 5 against euro this year.”