Romania raised €3.25 billion ($3.5 billion) via a two-tranche Eurobond, tapping international markets for a third time this year and exceeding its borrowing goal as the country is likely to need more funds to finance a bigger budget deficit.

The Balkan nation sold 2028 euro-denominated bonds at a final spread of 225 basis points over mid swaps and notes maturing in 2033 at 330 basis points, according to a person familiar with the matter, who asked not to be identified because they’re not authorized to speak about it. Total demand exceeded €7.5 billion.

The issuance comes after the national debt agency’s set a target of raising as much as €8.5 billion from the international market this year. Before the latest sale, Romania already issued around €6 billion in euro and dollar-denominated notes.

“Indeed, this reflects the government’s increased financing needs, as the 2023 budget deficit target was raised significantly,” Stephan Imre, a Vienna-based economist at Raiffeisen Bank International AG.

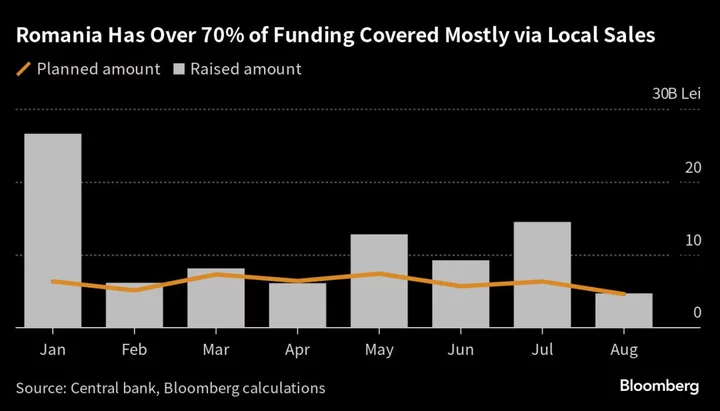

Like its eastern European peers Poland and Hungary, Romania has front-loaded its debt sales to take advantage of lower borrowing costs, relying mostly on sales of local-currency debt.

The government has estimated its gross funding needs for 2023 will reach 160 billion lei ($34.6 billion). Bucharest has been in intense discussions with the European Commission over the past month to temporarily increase the bloc’s mandated budget deficit target of 4.4% of economic output set out at the start of the year to 5.5%, as expenses increase and a cooling economy takes a toll on tax collection.

Read More: Romanian Finance Chief Warns on 7% of GDP Budget Deficit Risk

The EU seeks to keep budget deficits at no more than 3% of gross domestic products and hasn’t agreed to Romania’s proposal.

The Romanian government is expected to officially present new deficit figures following a budget review in the next few weeks.

--With assistance from Hannah Benjamin-Cook and Wojciech Moskwa.

(Updates with offer details from the first paragraph, analyst comment in fourth.)