Rivian Automotive Inc. is finally starting to realize the potential that investors saw in the electric-vehicle manufacturer back when it staged one of the largest initial public offerings ever.

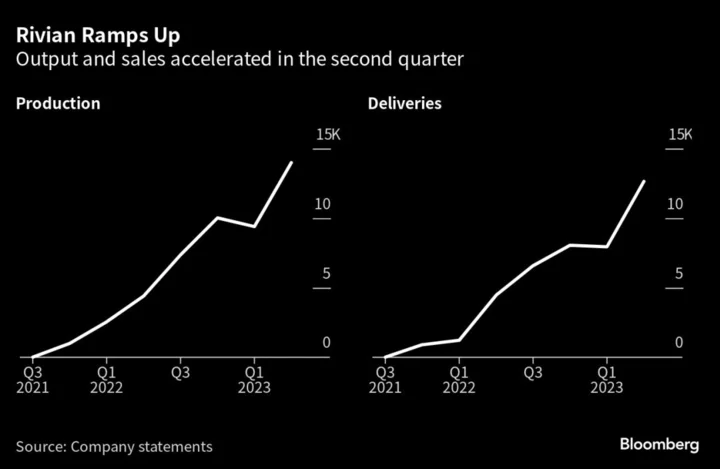

The maker of plug-in pickups, SUVs and delivery vans is coming off its best week since its November 2021 debut — the shares soared 48% after the company reported better quarterly production than expected and started shipping hundreds of vehicles to Europe for Amazon.com Inc., its biggest shareholder.

Chief Executive Officer RJ Scaringe still has a long way to go: Tesla Inc. built 34 vehicles for every one that Rivian assembled last quarter. But after a forgettable first year and a half as a public company that was plagued by supply-chain issues and missed targets, the 40-year-old founder is upbeat about having turned a corner from those early growing pains.

“Given that the supply chain confidence is there, and given that our operational experience is so much stronger, we’re able to have a level of predictability to the business that, in the first 12 months, we really didn’t have,” Scaringe said in an interview last week with Bloomberg TV.

What follows are highlights from Bloomberg’s extended conversation with Scaringe — some of which didn’t make it to air last week — about R2, Rivian’s next-generation vehicle platform; how he expects the company to benefit from the Inflation Reduction Act; and meeting demand from both Amazon and consumers. The excerpts have been edited for length and clarity.

How hard is it for you to delegate?

In the very, very beginning, I had a computer and I was designing parts in CAD. I don’t get to do that anymore, but I’m still way into the details thinking about improvements to the R1 platform, what’s coming in R2, and making sure that the organization is filled with people that are driving innovation across each layer of what we build as a company.

That innovation may exist in the sourcing realm, in the manufacturing realm, or in the product realm, but all those innovations need to be tightly coordinated. Looking at R2 to relative to R1, there’s an extreme emphasis on manufacturing innovation.

What more can you say about R2?

I’m immensely excited about what’s coming, because it takes a lot of what we did in R1 and sweetens it.

It’s a global platform. It’s sized to fit US, Europe and China really nicely. It takes what’s connected with the Rivian brand already — this idea of enabling and inspiring adventure — and takes it into a price point and a form factor that’s so accessible relative to where we are today.

Will this enable you to benefit more from the Inflation Reduction Act?

R1 is largely priced above the limits set by IRA, and the battery-content requirements are challenging.

On R2, the entirety of the program has been set up to make sure that it’s IRA compliant. So the sourcing of battery cells, where they’re produced, how the packs come together — all will be in the US.

The vehicle needs to be IRA-compliant, because that $7,500 customer-facing credit is really important in a vehicle at this price point. The price range in R2 will range from roughly $40,000 to $60,000. It’s really important that that $7,500 credit is built into that price.

What are you seeing in demand for the R1S SUV relative to the R1T pickup?

The first vehicle when we started production was the R1T, and up through the end of the first quarter of this year, roughly 75% of our production was R1T. The demand mix was roughly 75% R1S, so we were producing a disproportionately large number of R1Ts relative to demand.

We’re now getting that to a point where production matches demand. For the next few quarters, we’re going to try to catch up a little bit on R1S. For any R1 reservation holders out there, we know you’re waiting for your vehicles and there’s a lot of frustration with how long the backlog is. That’s something we talk about literally every day.

How is Rivian sorting through supply-chain issues?

Late last year, we brought all our suppliers to the plant for a day. The purpose of that was to say we can’t have a situation in 2023 where we’re a line down on a daily basis because of shortage of supply — where the production line is stopping because we ran out of a single part.

We had hundreds of our suppliers there — senior leaders, CEOs, senior executives — and I said, I want every one of you to look to your left and look to your right, and recognize that the volume that you’re going to get from us is based on how effective all of you collectively are at delivering on our asks.

That proved to be a galvanizing moment, where getting all our suppliers together in a room at the same time helped ensure that this year, we’ve really removed those supplier constraints we felt in 2022.

What do you want Rivian to be going forward: a consumer company, or a commercial vehicle company?

We knew that when Amazon made the commitment to us, and we made the commitment to Amazon, that we would be raising the bar for all other last-mile logistics providers to electrify. So we see impact not just through our own actions, but through the echo of competition.

We think competition is one of the most important things for this transition, and the same is true on the consumer side. I remember when I would meet with suppliers to talk about the R1T, they’d say to me, who would ever buy an electric pickup? And I’d make the pitch to say why we think electrifying the pickup space is important.

That vehicle helped galvanize and shift the mindset around the necessity of electrifying pickups, and we now see multiple offerings, each serving customers in a different and unique way. And that’s outstanding — that’s exactly what we wanted.